Hope everyone had a fun and safe holiday!

It’s been an interesting week for the economy.

The markets hit a new high, followed by a nice large sell off on Thursday.

Getting word from advisors around the nation that people are attending live events more than ever.

Recent growth + volatility = Investors Searching for direction (that’s you!)

Here are your Quick Hits:

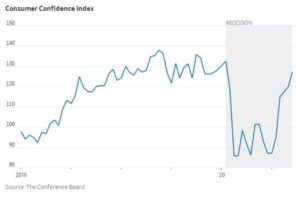

- Consumers’ appraisal of current business conditions improved in June.

- 5% of consumers said business conditions are “good”, up from to 19.9%.

- 5% of consumers claimed business conditions are “bad”, down from 20.6%.

- Consumers’ assessment of the labor market also improved.

- 4% of consumers said jobs are “plentiful”, up from 48.5%.

- 9% of consumers claimed jobs are “hard to get”, down from 11.6%

Why did the stock market sell off? Falling bond yields point to ‘growth scare’

- Before Thursday’s selloff, which saw large-cap growth stocks get clobbered alongside more cyclically oriented stocks, the worries had appeared largely invisible to the S&P 500 index because of its high-quality growth/big tech overweight

- “Our working theory is that we’re in the middle of a modest global growth scare…,”

Why Annuities Work Like a ‘License to Spend’ in Retirement

- Out of fear of running out of money, many retirees spend less than they could comfortably withdraw.

- Households spend more if they hold their wealth as guaranteed income, and not as investments, as they age.

- Retirees without a pension should consider buying an income annuity or delaying their Social Security claim.

Quick Articles on Social Security:

- A Woman’s Guide to Making the Most of Social Security – NY TIMES

- How Claiming Social Security Early Destroys Client Wealth

Quote of the week

“One of the marks of successful people is they are action oriented. One of the marks of average people is they are talk oriented.”

– Brian Tracy

Photo from the 4th

My Crew on the 4th of July…