It’s time to celebrate our birthday!

Nothing like a 4th of July party… it’s truly the obnoxious American tradition and I love every second of it.

Lots of over cooked meats, melting neon popsicles, watery beer, and things that can blow off your hand in an instant!

If those things don’t scream “‘merica,” I’m not sure what does!

Seriously though, enjoy the weekend with good friends and family…it’s the one day where we don’t argue about what’s wrong with our country, but be grateful for being in it!

Cheers!

Here are your Quick Hits:

Using Annuities to Mitigate Risk – Morningstar

- I thought this was a good generic article to help explain why you’d want an annuity in your portfolio.

- “Investments are risk purchased by the individual, and the individual mainly pays for the advice, but it is a risk acquisition. So, you have risk-on and risk-off and those are completely different worlds. And mainly, the risk-on people specialize in risk-on, and risk-off people specialize in risk-off.”

- “Before the retirement date or before you are approaching the retirement date, risk-on is fine. And things like sequence of returns don’t really matter. But as you get into retirement, it’s a different risk picture.”

Goals Are Only Guesses – Carl Richards form Behavior Gap

- This article was though provoking for me and had a great perspective on Goal setting and having goals in general.

- “It’s possible to be completely committed to a goal and at the same time open to changing it. Don’t change your goal just because it turns out to be harder than you thought to reach it. But you can change it if it no longer represents what you think you want to do. Remember, it was a guess.”

‘People Are Really Scared’: Gary Shilling Sees Warning Signs for Economy, Stocks

- Very solid article with some great data in it.

- Shilling says consumers are “very cautious,” not a good sign for a consumer-led economy.

- The housing market is beginning to cool

- He says the stock market is vulnerable to a correction, cryptocurrencies to a government clampdown.

- Shilling says if economic growth doesn’t live up to expectations, the stock market is vulnerable to a retreat. “You could see a 20% to 30% correction without being way out of line between now and year-end.” The reason, according to Shilling: The market is overvalued and there is still a lot of speculation, including in meme stocks.

A lot of the money created as a result of Federal Reserve stimulus policies has gone into stocks and into “rank speculation” in Bitcoin and in meme stocks such as GameStop. The S&P 500 is up 12% year-to-date.

Easier to create demand than to make supply – WSJ

- I love this quote. It shows how non-scientific some of the smartest people in the world are…

- “It turns out it’s a heck of a lot easier to create demand than it is to—you know, to bring supply back up to snuff,” Fed Chairman Jerome Powell

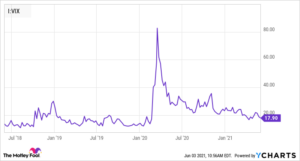

Volatility is at the lowest since the Pandemic began – Motley Fool

- “There are certainly reasons to feel optimistic as economic indicators and corporate earnings signal recovery. However, the full picture is a bit more complicated, and your investment portfolio should still be built to manage potential volatility spikes.”

Quote that hit me this week:

Written on the walls of Stanford’s Memorial Church:

“All that is not eternal too short, all that is not infinite too small.”

Have a great 4th of July Weekend. We truly live in the best country in the world.