Are you all feeling the disconnect between the economy that most of America is experiencing and the Stock/Bond market of America?

As advisors, this is the time where you can protect Americans from believing that our economy is at new highs before the actual economy pulls it back down to reality.

Keep the activity up – people need you more than ever!

Here are a few Quick Hits to use this week:

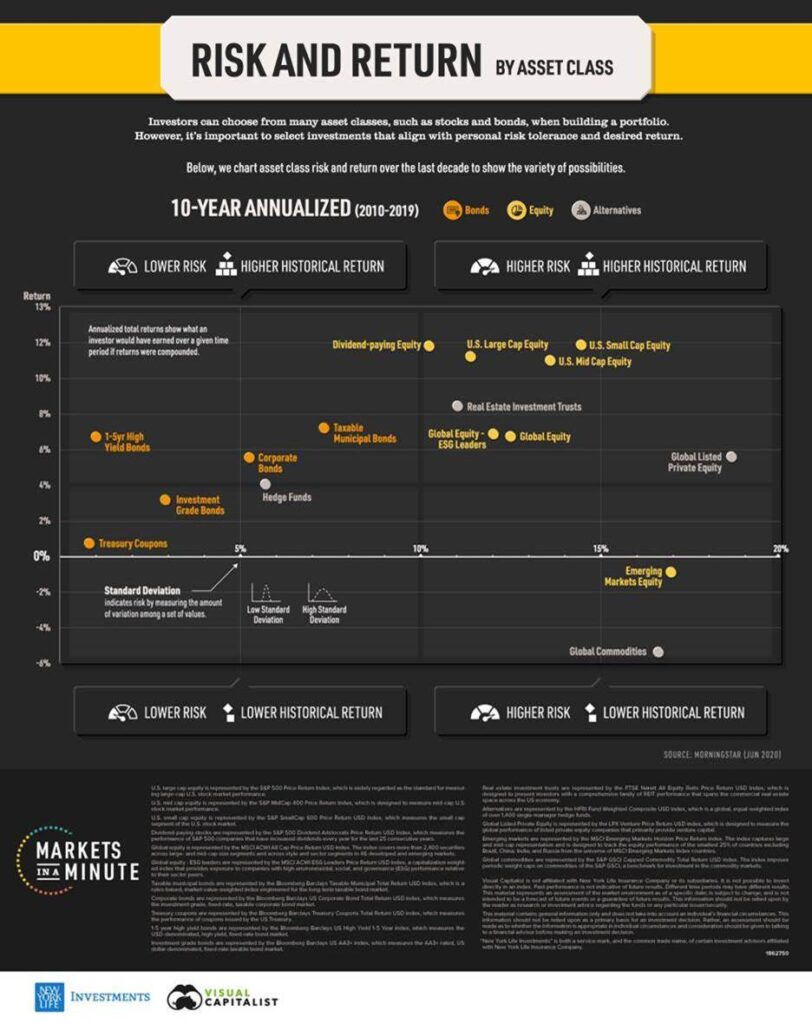

o https://advisor.visualcapitalist.com/asset-class-risk-and-return/

-Asset class Risk and Return over the last decade…sometimes the juice is not worth the squeeze. Am I right?

Goldman Sachs is 90% Positive the S&P will have an average of 6% for the next DECADE!

- If one of the biggest investment banks is saying to expect 6% returns if you were to invest in the markets…why invest when you can get a similar return without any downside risk!

Why you MUST have a sales email campaign if you capture leads

- I feel like a broken record here, but this is important!

- “If someone just requested a Whitepaper, a promo code, or a book you wrote from your site, that is why we must start treating them differently in the ONLINE sales process and why a sales email campaign is so important to your business.”

Rule 1 – Voluntary risks are more acceptable than involuntary risk.

- The perception of choice is powerful. Giving people choices on how to reduce risk can lead people to tolerate the riskier choice. People can be far more tolerant of risks they can engage in regularly (like driving a car) compared to ones they don’t (mountain biking).

Rule 2 – Acceptance is inversely proportional to prevalence.

- The more people who are exposed to a certain risk, the more the public will accept it. More people travel by plane than travel to space, so we couldn’t accept the same level of risk of space travel if that same risk was inherent in air travel.

Rule 3 – Disease is a yard stick.

- Humans have accepted the likelihood death at the hands of disease, so anything riskier than dying from disease appears to be absolutely unconscionable.

Rule 4 – Novelty increases perceived risk.

- We fear what is new and not understood. As your understanding of a topic goes down, the perceived risk of that topic (or activity) goes up. Ex. Nuclear power is ranked as the one of the most risky activities according to the public, but by experts it was ranked 20th and driving a car was ranked #1.

Rule 5 – Numbers are numbing.

- Humans can’t comprehend mass tragedy through statistics, so they aren’t an effective way to communicate risk to people. This is why people tolerate large scale disasters and mass casualty events compared to small terrorist attacks. People make decisions based on emotion and justify with logic (i.e. numbers).

We are putting the money back in your (Marketing) Pockets!!

-We are paying for 33% of all mailings until December 31st

-50% off with Steepdigital.com

-Buy 3 get 1 free with Whiteglove Workshops

“No price is too low for a bear or too high for a bull” – Stock Market Proverb