Marketing without tracking is gambling! (usually with better odds though)

As owners we know we NEED to be tracking all our marketing efforts, but how well do we?

Usually when things are working we tend to relax a bit, but when things aren’t “feeling” like they are working is usually when we try to go back and look at the numbers that…well…aren’t being tracked.

Make sure you are tracking your marketing efforts to the highest degree. If you aren’t, it’s gambling.

On the flip side…

Gambling can be fun with the right mindset, but can be addictive. Gambling with some extra $$ can be a way to find another funnel or different tactic that could work.

But

Don’t get addicted to the fun new marketing without tracking and making wise decisions.

As the great philosopher Kenny Rogers said:

“You’ve got to know when to hold ’em

Know when to fold ’em

Know when to walk away

And know when to run”

Here are your Quick Hits:

US Consumer Confidence Increased to it’s highest point since January 2021

- You may recall I bring this index up as well as the consumer sentiment index to see what our clients and prospects might be feeling right now.

- This is a good indicator to how the responses to your live events or direct marketing will be in the coming months.

- “January’s increase in consumer confidence likely reflected slower inflation, anticipation of lower interest rates ahead, and generally favorable employment conditions as companies continue to hoard labor,”

Small-Business Owners Air Their Succession Struggles Before Congress

- I thought this was an interesting piece on the honest side of business owning and where our country is at with the aging demographic of business owners.

- Sounds like a lot of opportunity for Financial Advisors to help!!

- “They’ve dedicated most of their time in business to building a successful company, and they don’t have the information or resources to think about next steps,”

- “Adding fuel to the fire is the number of small-business owners who have hit the age where they’re starting to think about retirement more closely. Nearly three million U.S. businesses are owned by someone 55 or older,”

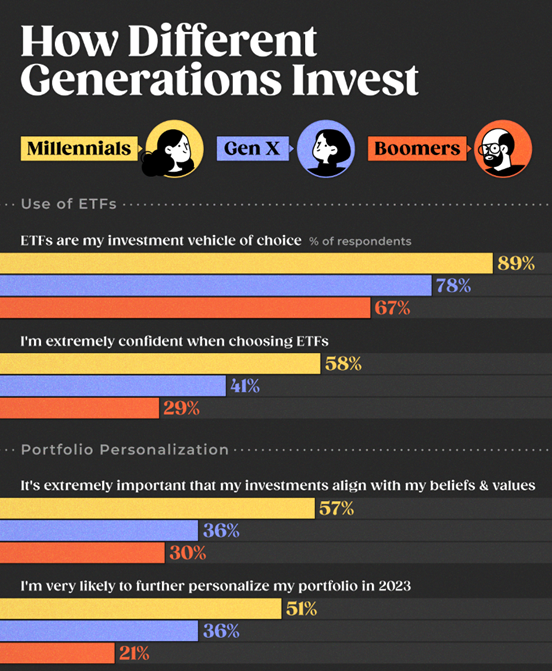

Charted: Investment Preferences by Generation in the U.S.

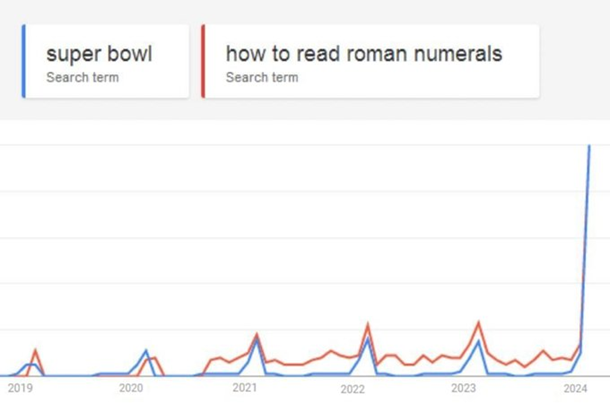

A chart to show the US education level (inversely)