Does anyone else feel like since sports are back the media has calmed down a little?

Maybe it’s just me but it’s almost as if they are taking a little breather… “Phew, we don’t have to write as much now that ESPN has something to talk about! Let’s take a European vacation… oh wait.”

The markets seem to be taking a little breather too.

Still feels like we are in that “window” before the election craziness starts to hit…

Here are your Sunday Night Quick Hits:

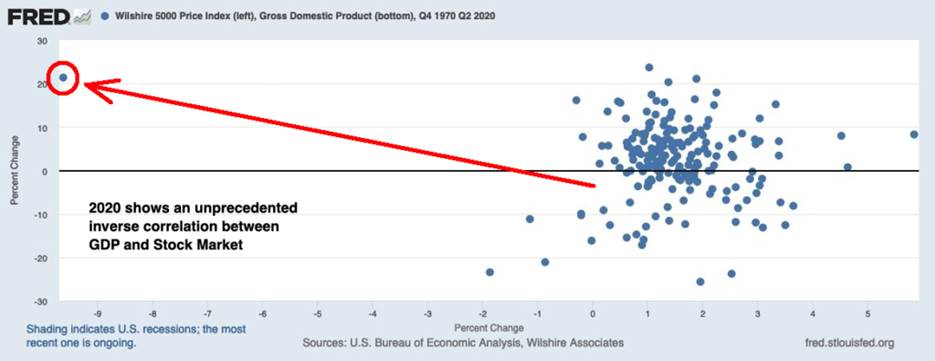

Unprecedented Times

· “If the unprecedented was truly rare, we would be living in a world that operated within the prior range of occurrences, and we know that is totally untrue. Just think about how often records are set for the fastest/biggest/strongest/most expensive/longest whatevers, and you will see that the unprecedented occurs with alarming regularity.”

It’s Here! Chapter 2 of the Second Half Playbook – Maximizing Existing Clients

As your trusted partner, we’re committed to bringing you field-tested tools and strategies designed to retain your clients’ confidence while capitalizing on new opportunities.

Resources

- Annuities Presentation: “The Ugly, The Bad & The Good”

- Referral Strategy

- Ambassador program

- Medicare Marketing

- Early Retirement

- Tax Marketing

- And More!

Remote Schools’ Hidden Cost: Parents Quit Work to Teach

· “Online school could force more than 4 million working parents out of labor force, researchers say”

· Another Large hidden item of what has happened in 2020 that makes you look at the Markets and wonder…

Desire to Stay Sane

100 Must Know Statistics About 401(k) Plans

· Some of my favorite stats from the article:

o $6.4 trillion: Assets in 401(k) plans, 2019.

o 43%: Percentage of all workers participating in a defined-contribution plan such as a 401(k), 2019.

o 76%: Defined-contribution plan participation rates, all workers who have Vanguard plans, 2019.

o 45%: Percentage of assets in all 401(k) plans that are in mutual funds.

o The Bigger the Plan, the Lower the Fees

o 0.58%: Total plan cost for average 401(k) participant, 2017. (Includes investment, administrative, and other fees.)

o $92.4 billion: Amount of assets that “leak out” from 401(k)s each year because employees cash out early, mainly following job changes, 2015

“The stock market serves as a relocation center at which money is moved from the active to the patient.”

— Warren Buffett