The election season is here and WOW. It. Is. Here.

Have you been getting all the political spam texts lately? “So and so kills baby elephants, she’s not the person to be trusted!”

If there was ever a lesson on how NOT to market or sell, it’s right now…get a notepad!

One message to share with your prospects over and over is “We’ll have a new president one way or another, but we won’t know until November. What we do know, is we have a window of opportunity in the markets until that point. Now is the time to take action!”

Here are your Quick Hits this week:

The Five Best 2020 Tax Planning Ideas

· #1 Roth Conversions…Duh

· These aren’t rocket science to you, but great value for your clients.

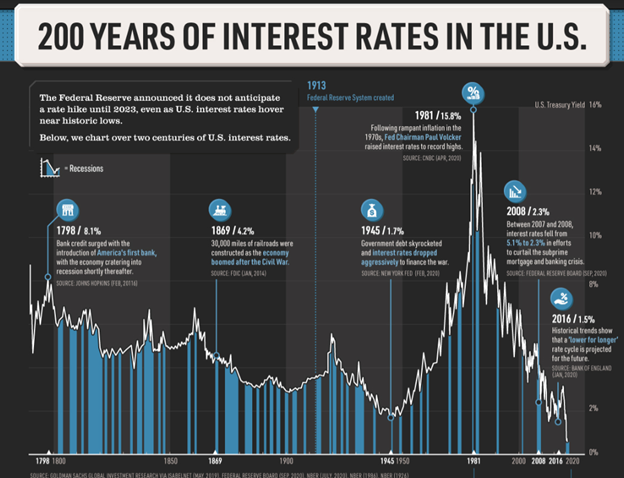

200 Year History of Interest Rates

· “Federal Reserve announced it does not anticipate a rate hike until 2023, even as US interest rates hover near historic lows

· “As near-zero rates seem more likely for the extended future, market distortions—such as ultra-low income yields—may become more commonplace. In turn, investors may want to rethink traditional asset allocations between fixed income, equities, and alternatives.”

Retirement Literacy Quiz Stumps 8 in 10

· Only 19% of participants passed the 2020 Retirement Income Literacy Survey, a 38-question quiz covering the basics of saving for retirement, life expectancy, long-term care, and related topics.

· 35% know (65% don’t know) that a sharp market downturn has the biggest impact on long-term retirement security if it occurs at the year of retirement, suggesting a lack of knowledge about investment risk in the years immediately before and during retirement.

Have you checked out Symetra’s Guaranteed Income that has the chance to be FREE to the client?

· Withdrawal benefit charges can be waived if indexed account performance meets or exceeds a certain threshold during the interest term.

How COVID has Altered the Conversation about Money – NY Times

· “Financial planning is all about taking care of your dependents, and women feel like they have more dependents right now,”

· “A lot of women are scared to sit down and say — What’s in my name? What do we have? Do we have any trusts? What’s this thing I signed?’ So many women don’t know what to do.”

Big Airlines are still Furloughing workers…

· Need more ammo around your message of “the window of opportunity?” Here it is.

Big Tip I learned This week: People Respect Rules.

· the best and most polite excuse is just to say you have a rule. “I have a rule that I don’t decide on the phone.” “I have a rule that I don’t accept gifts.” “I have a rule that I don’t speak for free anymore.” “I have a rule that I am home for bath time with the kids every night.” People respect rules, and they accept that it’s not you rejecting the offer, request, demand, or opportunity, but the rule allows you no choice.

· Learned this from Ryan Holiday’s “33 Things I stole from people smarter than me”