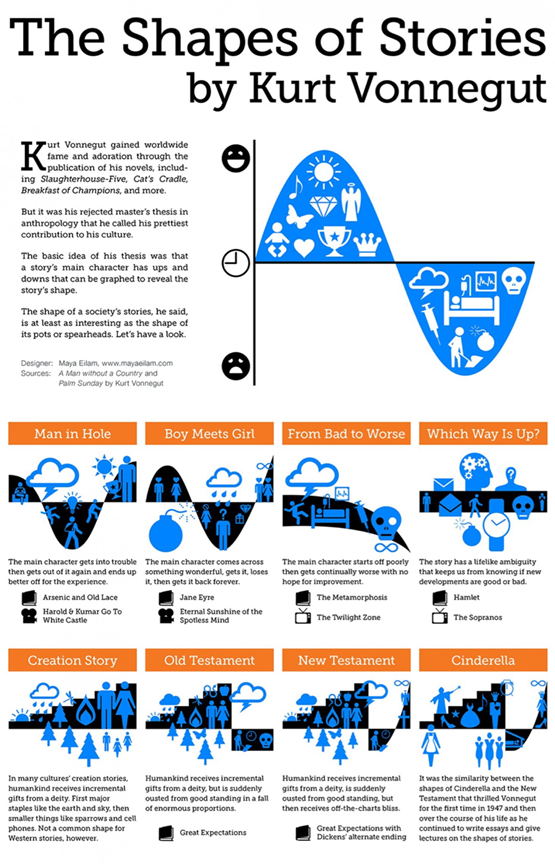

“Somebody gets into trouble, then gets out of it again. People love that story. They never get tired of it.”

This was a line from Kurt Vonnegut from an important video I want you to watch this week.

Check out the first quick hit and let’s make our stories more engaging!

Here are your Quick Hits:

The Shapes of Stories

- Read this twitter thread on Kurt Vonnegut explanations of story telling.

- Please watch the video inside the post if you tell stories AT ALL!

- Check out the chart below to implement the correct structure in your next story:

Does Adding Dividend Stocks Improve Portfolio Performance?

- I like articles that pose a question and back up with evidence for an answer. I’m sure clients do too.

- “The issue then becomes whether investors should own even more. If so, dividend stocks must deliver at least one of three benefits: 1) higher total returns, 2) lower volatility, or 3) better diversification. “

- “Of the 945 large-company U.S. equity funds that existed in 1998, only 137 have since outgained Vanguard Total Stock Market Index VTSMX. (More than half failed even to complete the journey.) Yet the average return for both the dividend stock indexes and the precost version of the funds managed that feat.”

What my $30 hamburger reveals about fees and how companies use them to jack up prices

- Anyone else done with all the fees but still getting “free shipping?” I am!

- “It’s fees — fee-flation” says Jeff Galak, professor of marketing at Carnegie Mellon University’s Tepper School of Business. “Fees are a way to raise prices without raising prices.”

- “This is what’s known as stealth inflation.”

Investors Need to Worry About the Bond Market’s Return to Normality

- Bonds have been the topic of conversation the last few years as they are supposed to have been the steady return that we all look towards during volatile times but they have not. This article gives a rebuttal that we might not be back to normal.

- “The risks are twofold. First, we have only just started to test the ability of the economy to withstand higher rates. This is most obvious in rising loan default rates, weaker demand to borrow and a sharp tightening of lending standards by banks. So far, only the very weakest borrowers have hit trouble.”

- “The stock market doesn’t seem to think any of these dangers are real, and maybe shareholders who have driven up Big Tech stocks in part for other reasons, such as bets on artificial intelligence, are right not to care about them. But as the effects of higher rates ripple through the economy, it feels as though the stock market is channeling another of Douglas Adams’s characters, who said: “I’d far rather be happy than right any day.””