Here are your Quick Hits:

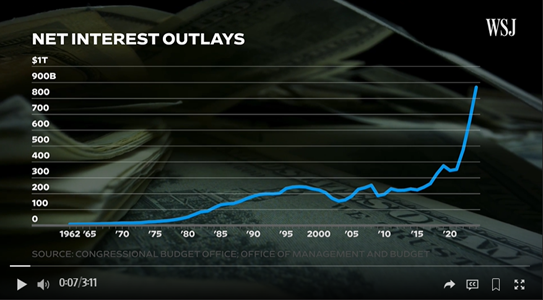

Record-High Interest Payments Could Make the National Debt Matter

- This video is POWERFUL. Think about how you might be able to use in your marketing. Could this be used in your workshops? Follow up emails? Client events?

How Much Money You Need To Retire In Every State In America

- Love pieces like this that don’t make a ton of logical sense, but fun to read and look at the state you live in or in this case, the one you want to live in.

- “The good news is, for those who aren’t high-income earners or planning to have several million in net worth by retirement, the vast majority of states require less than $1 million in savings to retire. Shocking, right?”

- Kansas is the second cheapest state on this list, with an estimated retirement savings number under $600,000. There’s no place calling Kansas home in retirement. The median household income in Kansas is $61,091. The annualized cost of living in Kansas is an estimated $41,346.15. If you want to retire in Kansas, you’ll need about $579,232 in savings to live comfortably.

Are We in a Productivity Boom? For Clues, Look to 1994.

- The 90s was an awesome decade – am I right?! This piece proves it.

- “The last time the American economy was posting surprising economic growth numbers amid rapid wage gains and moderating inflation, Ace of Base and All-4-One topped the Billboard charts and denim overalls were in vogue.”

- “One retrospective on the 1990s boom found that a combination of efficient computer manufacturing and increased information technology use accounted for about two-thirds of the era’s productivity pickup.”

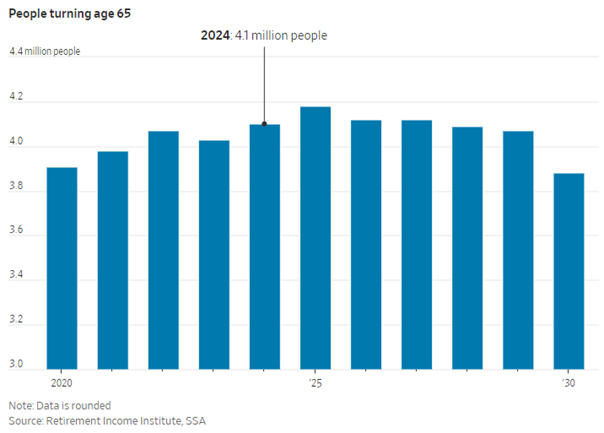

America Has Never Had So Many 65-Year-Olds. They’re Redefining the Milestone.

- What an incredible time to be a Retirement Focused Financial Advisor!!

- “About 4.1 million Americans will reach 65 years old this year, reaching a surge that will continue through 2027,”