You thrive in uncertain times.

You are like superheroes when the night seems very very dark.

Don’t believe me? – Google “Are we in a recession?” then click “News.”

- CNN – Why we think we are in a recession

- YAHOO – We see a shallow recession

- Fortune – We are headed for a profound economic shift

- Forbes – The recession will begin late 2023

Here is the tool we use to predict recessions from Forbes – Yield Curve Inverts To Depths Not Seen Since 1980s, Raising Recession Fears

There is a lot of uncertainty, but the more important question is, “are your prospects FEELING the uncertainty?”

If it’s yes, your superhero call light is on, put the marketing cape on and save some retirees!

No? – open up the eggnog early I guess…

Here are your Quick Hits

Top 8 Maxwell Books recommended by John Maxwell

- At the AE Leadership Summit John shared with the group his most impactful books he’s written.

- The list was slightly socking as it didn’t include any of the ones that were most impactful for me!

What the Inverted Yield Curve Says About the Next Recession

- What’s happened since July is the inversion, unlike all others since the early 1980s, has become deeper so that the two-year yield is now almost 80 basis points, or 0.8 percentage point, higher than the 10-year yield.

- Investors are naturally now asking whether the next recession will be longer and deeper than any of the previous 40 years?

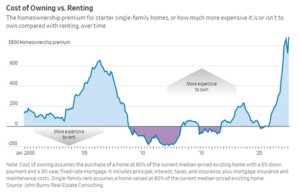

As Mortgage Rates Rise, More People Choose to Rent Single-Family Homes

- Increasingly, U.S. consumers faced with inflation and the high price of homes are pressing the pause button on home buying. The rate on an average 30-year fixed mortgage is now 6.61%, more than double what it was in October 2021.

Couples Who Combine Finances Are Happier. So Why Don’t More Do It?

- Married couples hold four times as much wealth as unmarried couples who live together, and researchers point to combining finances as one reason why.

- “A lot of people have money trauma they bring into relationships,” he said. “How money and relationships interact is based on people’s personal history with money.”

- But the benefit of combining finances might outweigh those risks, especially for those with less wealth, Prof. Gladstone said.

Annuities Are Popular Amid Volatility. But Critics Remain.

- “One of the common misconceptions about annuities is that there is a right or wrong time to purchase one,” he said. “In any economy, and at all stages of the financial life cycle, annuities can provide protection and guaranteed income, helping clients prepare to navigate adversity now and in the future.”

- “But annuities help address a serious problem for workers, especially most private sector workers who lack pensions—having enough secure income to last throughout retirement.”