Over the last few years we’ve gotten used to change (or maybe at least better at it) and now that we actually need and want some change it feels like we are in a revolving door.

Here is what I mean:

- Inflation is still at an all time high (10th month above 6%)

- The Fed is going to raise rates…again

- S&P 500 is still hovering down 14-18% for the year

- Gas prices are still up across the nation

With still no change in these large economic trends, it’s all the more reasons for retirees to make a change to start working with you!

Carpe diem!

Here are your Quick Hits:

Interested in knowing what your business is worth? – Listen to this

- Whether you want to know what yours is worth or you are looking to purchase another advisor’s business, please give this a listen.

- A huge takeaway is how the “Multiple” conversation is very case by case and it’s not a generic number that goes with the market.

Retirement Planning Means More Than Saving in Your 401(k)

- “Most Americans don’t have a retirement plan, even the ones who max out their 401(k)s.”

- “Without a plan, some end up spending most of their day watching television or online.”

- Work on building what you consider an ideal life before you retire to ease the adjustment, said Mr. Laura. For example, start a healthy eating routine today, have friends to socialize with outside of the workplace, and stay involved in the community by attending events before you give your notice, he said.

- “Retire from work, not from life,”

20 IRA Mistakes to Avoid

- I’m not going to copy all 20 here, but I thought this article was a good one to share, topic on the radio or have in your waiting room.

- “there are plenty of ways investors can stub their toes along the way. They can make the wrong types of IRA contributions—Roth or traditional—or select suboptimal investments to put inside the tax-sheltered wrapper. And don’t forget about the tax code, which delineates the ins and outs of withdrawals, required minimum distributions, conversions, and rollovers. Rules as byzantine as these provide investors with plenty of opportunities to make poor decisions that can end up costing them money.”

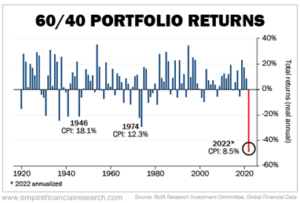

Worst Year on Record for 60/40 portfolio