Today we wrap up the Advisors Excel Journey Event in Dallas which ended up being our best attended Journey EVER!

AE advisors also had their biggest month in AE history!

It is becoming crystal clear that retirees are looking for the custom, independent, and retirement focused help from advisors like you.

Thank you for all that you do, and by the looks of articles below, there are still plenty that need your help!

Here are your Quick Hits:

Becoming a Leader Who Has “It” | Lead Like It Matters,

- I thought this short 2 part series was super good for any leader.

- “Most leaders delegate tasks, but the best leaders delegate authority.”

- “The best leaders are urgent and patient.”

- “Leaders with it urgently drive the right actions. These leaders aren’t always right, but they’re always moving toward action.”

- “Action closes the gap between what you have and what you want—and small wrong actions often precede the right big ones.”

The Biden Administration Has Approved $4.8 Trillion of New Borrowing

- “Excessive borrowing will lead to continued inflationary pressures, drive the national debt to a new record as soon as 2030, and triple federal interest payments over the next decade – or even sooner if interest rates go up faster or by more than expected.”

- “In total, the Biden Administration has added $4.8 trillion to deficits over the 2021-2031 period as a result of legislative and executive actions. With inflation at a 40-year high and debt headed for record levels, substantial deficit reduction will be needed to put the country on a sustainable fiscal course.”

Mortgages Surge Past 6% And Hit Their Highest Level Since 2008: Housing Market Could ‘Torpedo’ U.S. Economy, Expert Warns

- “Existing home sales and mortgage applications have both taken a hit amid rising interest rates and looming recession fears”

- “Traffic of prospective buyers, meanwhile, also hit its lowest level since June 2020, with new buyers hard-hit by “declines for housing affordability,””

- “Mortgage rates going forward will continue to be responsive to changes in expectations around the Fed’s policy path, as well as inflation expectations,” he predicts.

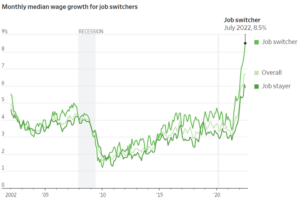

Now Is the Most Rewarding Time to Switch Jobs in Years

Quote of the Week:

“It is very much our view, and my view, that we need to act now forthrightly, strongly, as we have been doing, and we need to keep at it until the job is done.”

~ Fed Chairman Jerome Powell