S&P is back to where we started the year off. Great! Everything is back to normal!

Ummm.

Does it feel normal to you?

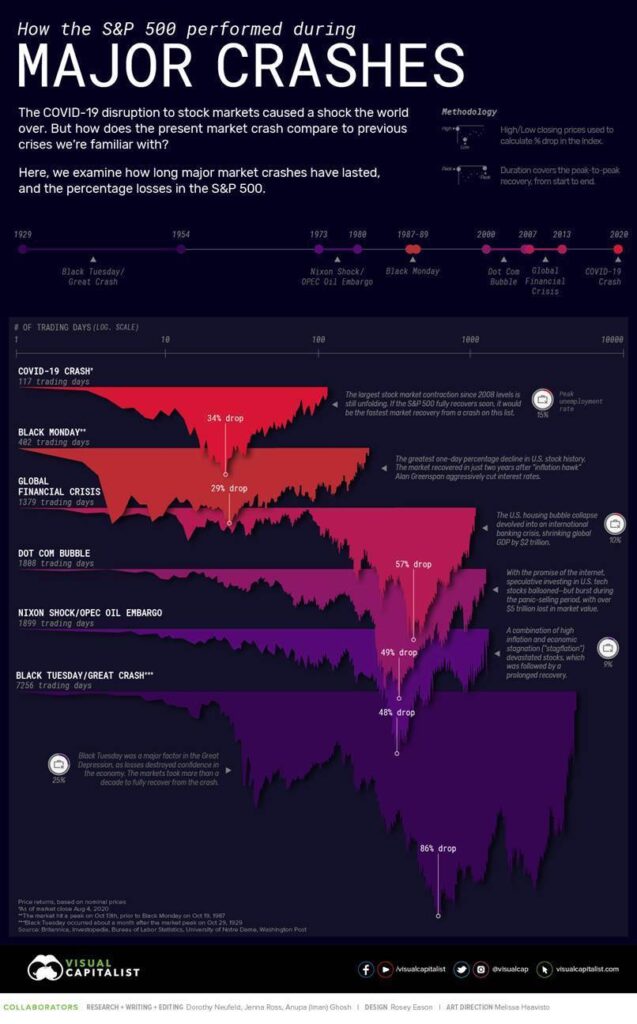

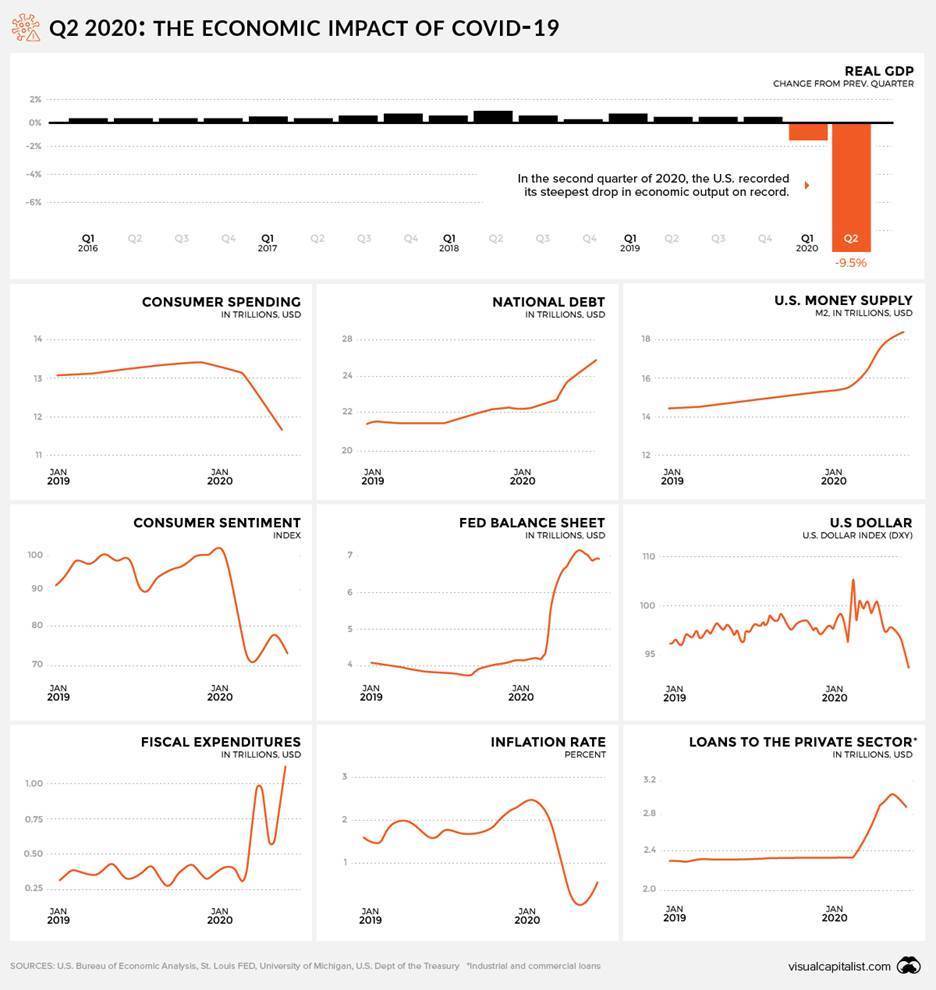

Unemployment still extremely high, bankruptcies at all time high, GDP had it’s steepest decline ever… but HEY! We are back to normal, let’s keep investing like we did at the start of the year right?!

People need safety now more than ever. We got the rebound we needed…we got our losses back. If you are near retirement or in retirement, now it’s time to walk away from the table.

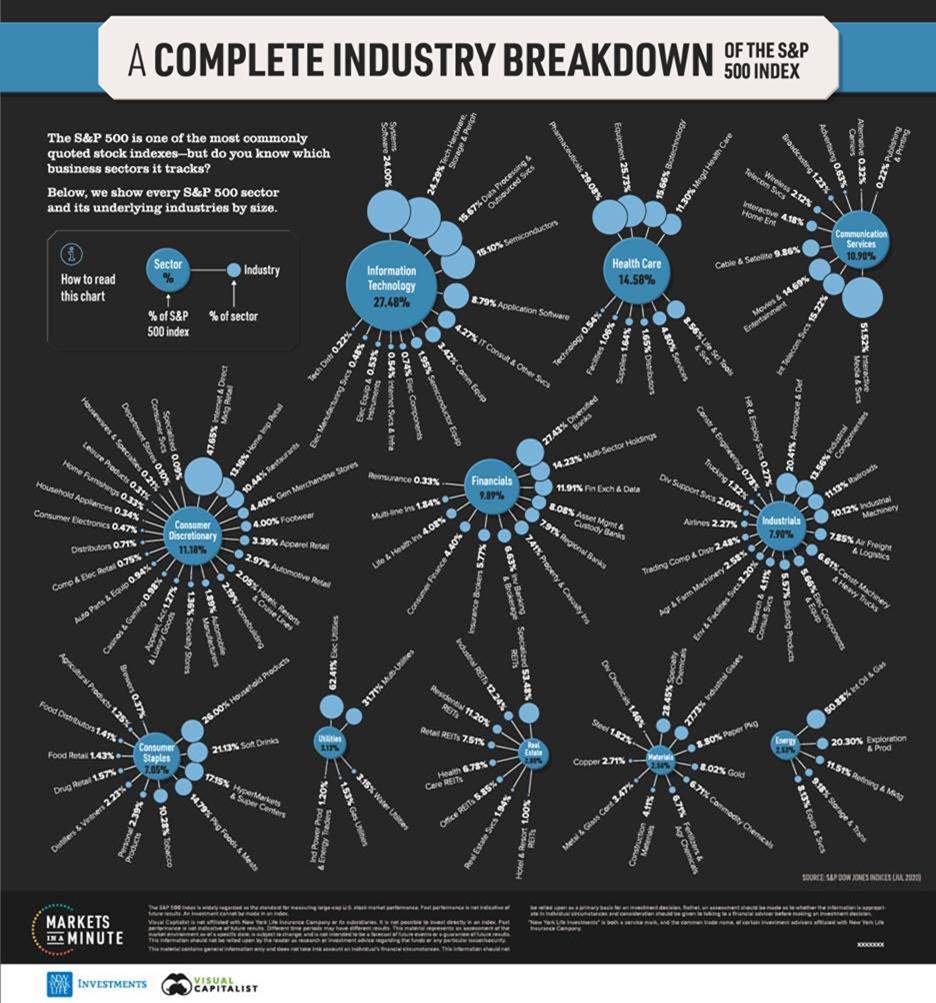

Here are a few articles and charts to PROVE it!

Make it a great week!

Quick Hits

How the S&P 500 Performed During Major Market Crashes

All S&P 500 Sectors and Industries, by Size

o Q2 of 2020 was the STEEPEST drop in economic output EVER!

Yahoo Finance: With Interest Rates Near Zero, Annuities help Pick Up the Slack

o Powerful Statement about annuities:

o “What must happen in the stock and bond markets for her to find that additional 11% that she would have gotten with annuities? Unfortunately, if and when interest rates go up, the price of the underlying bonds will likely go down, decreasing the value of the portfolio. Based on our studies, there’s almost no scenario that works better than adding annuity payments to her retirement mix.”

Morningstar: 4 Key Annuity Types

o Good non-biased annuity article that outlines the 4 different types.

o “Many annuities are complex and often lack transparency. As a result, savers have gotten scared away from even those annuities that are quite simple and relatively easy to understand.”

Marketing Lessons from Pop Tarts

o Stop selling the “No Obligation, free appointment!” No one wants that!

o Start walking someone through a 3 step process on how to get the value you provide.