2 minutes left, you’ve got the ball on the 5 yard line and you are up by 3 points. You are winning, but if you punch the ball in the endzone you completely remove the chance of your opponent being able to score to beat you.

Do you slow up and try to let the clock run or drive hard and finish strong?

You are running a marathon and you are less than a mile out. You can see the finish line… do you slow down or speed up?

All of the sudden you have a boost of energy right?

This is where we are. It’s the beginning of December, there is a lot going on, and it’s easy to take the foot off the gas…

Do you speed up or slow down?

24 Don’t you realize that in a race everyone runs, but only one person gets the prize? So run to win! 25 All athletes are disciplined in their training. They do it to win a prize that will fade away, but we do it for an eternal prize. – 1 Corinthians 9:24-25

Here are your Quick Hits:

Ed Slott: Inflation Has Created an Unprecedented 4-Year Roth Conversion Opportunity

- Great article to back up your planning suggestions on doing roth conversions right now.

- “advisors need to counsel their clients to consider a four-year Roth IRA conversion plan now since the tax rates are the lowest “most people will see in their lifetimes,””

These are the top 5 ‘financial regrets’ of Americans over 50

- I love articles like these to share on the radio or send out in your weekly drips.

- “One of the great problems with retirement planning is that by the time we realize the big mistakes we’ve made it’s usually too late to do anything else.”

- “the No. 1 financial regret of older Americans, shared by a thumping 57%, was not having saved more for their retirement during their working years.”

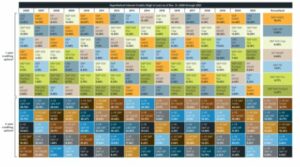

We’ve all seen the “Skittles” charts for market diversification but have you seen an FIA Skittles Chart?

- This chart is from one product with Security Benefit called the Strategic Growth, and I thought it was a good depiction of how not one strategy inside of an FIA is the best.

- This is a solid whitepaper put together by F&G Life that brings up an important topic to be bringing up in your appointments, seminars and media.

- I think we are going to start hearing the term “Sequence of Inflation Risk” a lot more coming up.

- “It is possible for two retirees to lose an identical amount of purchasing power over 20 years, yet one retiree will experience a significantly higher cost of spending because they experienced higher inflation earlier in retirement.”