We made it! Yes, the last month of 2020!

While 2020 threw a couple jabs and maybe even a couple hooks that connected on our jaw, we are still standing and here at AE we are ready to send a few quick jabs right out off the bell of 2021!!

We have a lot of things in the final stages and ready to roll out in January that I am absolutely jacked about and you will be too!

Stay tuned and let’s finish the year strong!!

-Cory

Here are your Quick Hits:

How can advisors help clients through market Anxiety – Morningstar

- Historical performance, where the advisor framed the market downturn as a path to increase the value of their investments,

- Story, where the advisor framed the market downturn itself as a reason to stay in the market, and

- Opportunity, where the advisor framed the downturn as an opportunity to buy a stock at a discount.

Planning Beats Predicting – FA Magazine

- “Is he right that 4.5% is a good bet for an initial withdrawal, or will it be below 4%, as many others have predicted? News flash: We won’t know for quite some time. But with good financial planning, it really doesn’t matter.”

- “Not much can be guaranteed in life other than that it’s full of changes. If you know one might happen and what can be done when it does, a change can be far less scary. Rather than relying on predictions, rely on the ongoing and dynamic process of financial planning.”

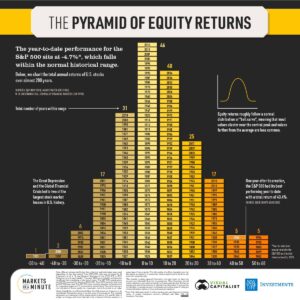

The Pyramid of Equity Returns

Advisors need to get personal in their Digital Efforts to compete – FA Magazine

- “According to a recent survey by eMoney, Americans want digital marketing that is customized for their needs. Most respondents (84%) indicated that personalized content is very important when working with a financial advisor. And nearly a third (63%) said insightful and educational content, as well as personalization, would make an advisor’s marketing stand out among their competitors.”

- “In fact, 42% of respondents said they start the process of finding an advisor online.”

What Lies ahead?: Economic Projections for 2021

U.S. Consumer Spending Grows for Sixth Straight Month, Albeit Slower – WSJ

Investor Optimism explains Stock Prices – WSJ

- “Among the big reasons for climbing stock prices is investors’ optimism about the strength of the economic recovery in the years ahead.”

True Life – I did a Roth Conversion

2020 Rewind

6 Ways to Generate Revenue from Your Existing Book – DB Video