Good Afternoon, AE Partners!

As of this past week, the S&P 500 has surrendered nearly half of the gains since March of 2020 bottom…

What a ride right?!

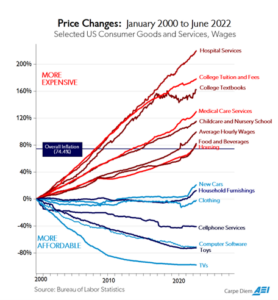

Not exactly the ride you want to be taking when you are in the retirement red zone. Once again the Consumer inflation has hit another 4 decade high. And I hope your retirees aren’t looking to buy a house any time soon – Mortgage rates hit a 20 year high.

I was talking with one of your peers this week and she said this that I thought echoed probably how a lot of you feel every day…

“When I lose out on a prospect, I’m not worried about losing out on the revenue they might have brought me any more, I’m worried they are going to go down the street and not be taken care of the way we would take care of them. I’m worried they will come back to me with half of what they originally had and ask me to fix it then.”

Love your passion for what you do for retirees.

Make it a great week!

Cory

Here are your Quick Hits:

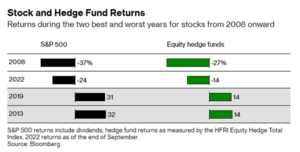

Hedge Fund Managers Paid for Stockpicking Genius Aren’t Showing Much of It

- This article made me feel a little better about not having access to these hedge funds that the HNW do, I’m sure it will for your clients as well!

- “But the performance of these would-be wizards has slipped, just when their clients need them to soften the blows from the most ferocious market selloff in more than a decade. Equity hedge funds are down 15% this year, according to data compiled by Bloomberg.”

PULLING THE CURTAIN BACK: WHAT DO MILLIONAIRES INVEST IN?

- “By surveying a sample of 2,484 U.S. respondents…the authors examine four categories of factors (investing in equities, concentrated stock ownership, cross-section of stock returns, and active equity investment managers), to find out : What drives these investors’ investing decisions?”

- I thought this point was interesting

- “The wealthy’s beliefs about financial markets and the economy are surprisingly similar to those of the average U.S. household, but the wealthy are less driven by discomfort with the market, financial constraints, and labor income considerations.”

This May Be Worst Year Ever For Famed 60/40 Portfolio

- “…the famous 60/40 allocation reached its most expensive level in almost five decades during the Covid-19 rally. The situation has reversed in 2022, which is now by some definitions the worst year ever for the bond-and-equities cocktail.”

- Here is some overly speculative positivity for you…

- “It would make sense that if this is the first time in decades that both sides are beat up that it’s likely to be a better diversified equity portfolio mix and going to work because you’re actually starting to get the opportunity for yield on your 40%,” he said. “Plus, stocks are trading at lows, so the potential upside return now looks much better for both.”

Chart of the day or Century?