Main team!

Fall is right around the corner, and with it comes a shift in energy.

Vacations are wrapping up, routines are back in place, and clients are taking stock of where they stand heading into year-end.

For advisors, this window is prime time: prospects are more focused, and small nudges now can translate into big wins before December.

Here are your Quick Hits:

Why More People Fear Going Broke in Retirement Than Dying

- Rising costs, election-year uncertainty, and market swings are creating analysis paralysis.

- Many are delaying big financial decisions or even meetings with advisors.

- Advisors should simplify next steps into smaller, more digestible actions instead of pushing full financial overhauls.

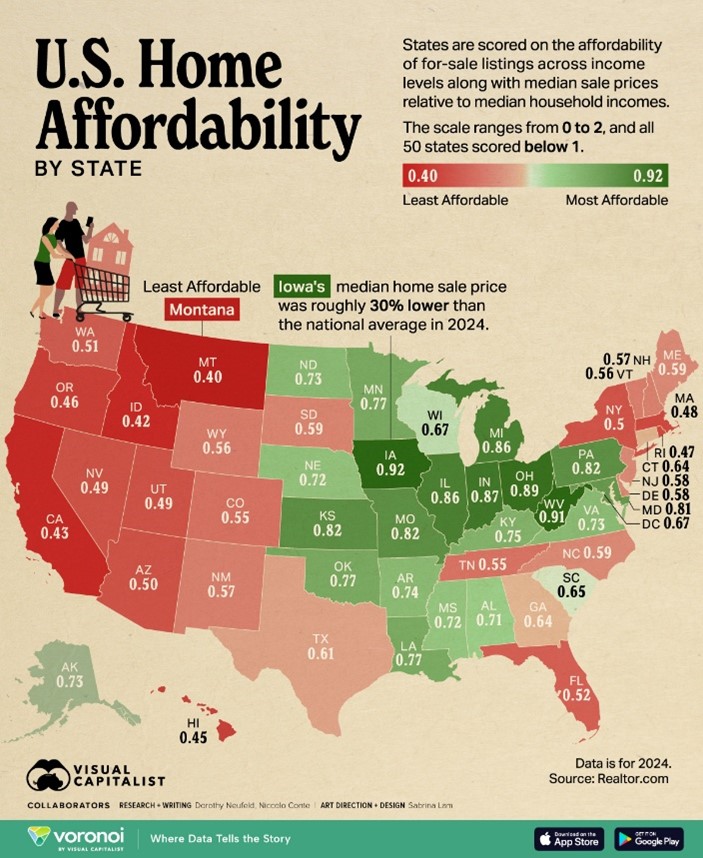

Mapped: Where Housing Is (and Isn’t) Affordable

- Only a handful of states have average home prices that align with median household incomes.

- States like West Virginia and Ohio remain relatively affordable, while California, Hawaii, and New York are the least affordable.

- Affordability pressures mean retirees often consider relocating—or downsizing—as part of their retirement plan.

AI in the Insurance Industry: What It Means for Advisors

- AI is rapidly changing underwriting, claims, and customer service.

- Carriers using AI are moving faster and more cost-effectively.

- Advisors who adopt AI-driven tools will be able to keep pace and add more value to clients.

What Retirement Looks Like Margaritaville

- Lifestyle-based retirement communities are booming.

- Fun, themed living environments (like Jimmy Buffett’s Margaritaville) attract retirees who want more than golf.

- This trend shows retirees are focused on experiences and community as much as finances.

- Action: Talk with clients about what their “dream retirement lifestyle” looks like—not just the numbers.