Here are your Quick Hits:

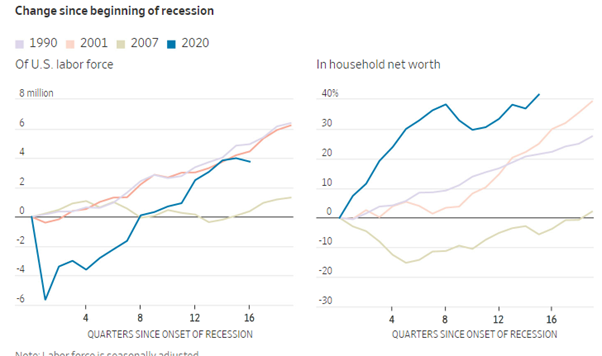

Why the Recession Still Isn’t Here

- A question on a lot of people’s minds…solid article to share with clients this week.

- “Of course, just because everyone who predicted a recession has been wrong doesn’t mean they won’t eventually be right.

Clients Might Want To ‘Use Not Lose’ Expiring Estate Tax Exemptions

- GREAT article to share with clients who are on the fence about tax strategies you’ve showed could save on taxes in the future.

- “With the large $37 trillion government debt and many on the progressive side wanting to ‘tax the rich,’ many investors feel it is likely that this current benefit will go away. I think wealthy people will feel they will regret not taking advantage of a current tax benefit that may be lost,”

- Wealthy investors using the exclusion now can preserve almost $28 million in assets that won’t be taxed when they die. “Using your lifetime exclusion is very powerful because it takes assets out of the estate, which would otherwise be subject to a 40% estate tax at death, plus a potential second-generation skipping tax,”

Lazy Work, Good Work – Morgan Housel

- If you struggle with asking yourself “what did I do today” at the end of the day of decision making and thinking like I do sometimes. This article will make you want to plan for more days like that!

- “Thirty-eight percent of jobs are now designated as “managers, officials, and professionals.” These are decision-making jobs. Another 41% are service jobs that often rely on your thoughts as much as your actions.”

- “The point is that productive work today does not look like productive work did for most of history. If your job was to pull a lever, you were only productive if you were pulling the lever. But if your job is to create a marketing campaign, you might be productive sitting quietly with your eyes closed, thinking about design.”

- “But as the economy shifts to knowledge work, we should respect that what actually produces good work can at first look lazy, and (even more so) vice versa.”