Hey hey!

I found quite a few articles this week for you to use with clients and prospects or use as talking points on your radio and TV.

One in particular was super interesting which is the The Surprising Risk That Turbocharged a $142 Billion Bank Run.

Here is a quote from it that you all preach day in and day out, but it’s nice to have someone else say it to your clients too right?:

“The hardest risks for organizations to hedge are the ones they can’t envision. Even financial institutions in the very business of pricing risk are vulnerable to what they don’t see coming.”

~ Ben Cohen

Make it a great week!

Here are your Quick Hits:

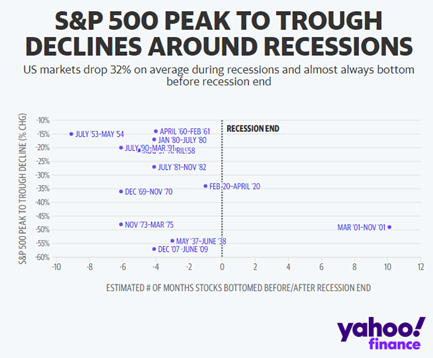

Could the stock market power through a recession? ‘This would be rare.’

- Solid article to share with clients & Prospects.

- “Going back to 1937 — the Great Depression period for the U.S. economy — the S&P 500 (^GSPC) has sold off in a range of 14% to 57% peak-to-trough during periods of recession, per new data crunched by Calvasina. The average recessionary drop on the S&P 500 has tallied 32%.”

- “Typically, the stock market bottoms four to five months before a recession ends, but RBC’s research details that it has bottomed as early as nine months before the end of a recession.”

How to Prep Clients for Social Security Claiming Choices, Possible Cuts

- “Franklin said that if she were an advisor with clients 55 or younger, she would stress test their Social Security claiming strategies, including reducing the overall amount by as much as 20%.”

- “Clients should be responsible for filing for their own benefits with SSA either in person, over the phone or online. “But the strategy of when your clients should claim social security benefits, that’s your job. And I think it really plays into this more holistic view of financial planning. Investing is just one small portion of it.””

‘Non-Ideal’ Clients Present Productivity Challenge for Advisors

- “Senior advisors often need to face the reality that, while many of these clients were reasons for their early career survival and ultimate success, these relationships now may be far from ideal,”

- “91 percent believed serving too many non-ideal clients was a moderate or major challenge. Other top challenges included lack of process mapping and documentation (86 percent), and ineffective delegation of staff (86 percent).”

Married Couples Are Leaving 401(k) Money on the Table

- “There is a positive correlation between not optimizing retirement savings and less durable marriages.”

- “Roughly a quarter of married couples in which both spouses have retirement plans appear to allocate their individual contributions in a way that fails to optimally exploit the employer match incentives available at the household level.”

The Surprising Risk That Turbocharged a $142 Billion Bank Run

- Interesting article on the SVB collapse and it’s correlation to social media.

- “The forces of social media have spilled into every part of society, but it seemed improbable that a prominent institution could be toppled in two days by a barrage of tweets, if only because the human mind struggles to picture anything that has never happened before. And never before had a bank with so much money gone bust in such a bizarre way. Now it has.”