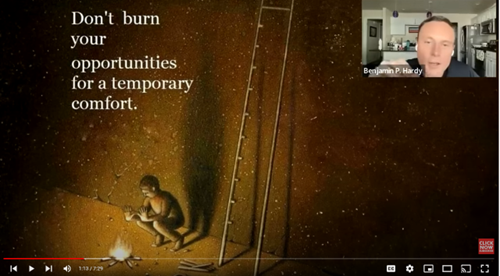

Don’t burn your opportunities for temporary comfort.

Check this video out this week – it’s powerful. How To Reprogram Your Mind For Success

A big idea I took away was on the business side, how do we self sabotage our businesses for short term comfort.

- Are you hiring the friend or family member because you absolutely need help right now when you know they aren’t a great fit long term?

- Are you not willing to save the funds to go after the next big marketing funnel?

- Are you settling for the cheaper office space?

Are you thinking short term or long term on your business decisions?

Make it a great week!

Here are your Quick Hits:

The Exact Age When You Make Your Best Financial Decisions

- Solid article to use this week!

- “Financial decision-making requires a combination of reasoning skills that differ by age. Those in their 20s are better at absorbing and processing new information and computing numbers—so-called fluid intelligence—but don’t have as much life experience or crystallized intelligence—the accumulation of facts and knowledge. Crystallized intelligence tends to improve with age.”

The Link Between Entrepreneurship and Mental Health Conditions

Baby Boomers Are Overestimating Future Social Security Income

- “Many older Americans are already wondering how they’ll afford a retirement that could last 30 to 35 years, and that, according to some surveys, requires $1.8 million. The average Baby Boomer’s 401(k) account balance at Fidelity Investments is around $220,900.”

- “But if no action is taken — as waves of boomers leave the workface and fewer younger workers are sending payroll taxes into the pay-as-you-go system — current benefit levels could be cut by 23%, according to the Congressional Budget Office.”

Stay Ready – post from Jesse Itzler

- Past AE Speaker Jesse Itzler posted this and I thought it was worth sharing!

- “Even when I take time off, I try and remain at some level of “readiness”. Never want to work back up from zero. That takes too much energy….and why give back all your hard work to be in the ready position!”

Bad Timing Cost Investors One Fifth of Their Funds’ Returns

- Time and again, we have found that investors in allocation funds capture a greater share of the funds’ total returns. Why? They are designed to be all-in-one holdings given they span multiple asset classes and rebalance on a regular basis, sparing investors from having to do much maintenance.

- Another clear finding from the study is that investors have struggled to successfully use narrowly focused or highly volatile funds.