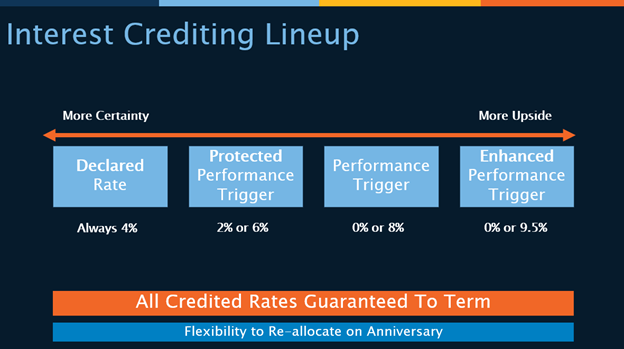

Interest rates are dropping, which is great for mortgages and buying cars, but FIAs will take a hit on their rates…

I don’t think American National could not have launched their Rate Certain Annuity at a better time!

If you are looking to be the “Hero” financial advisor and lock in your clients’ rates and caps for 7,10 or even 20 years, this product does just that.

Call our team if you want more info – here is a little snap shot:

Here are your Quick Hits:

BOA Podcast – Interview with Tony Robbins

- Cody’s recent interview with the “World Renowned Life and Business Strategist” Tony Robbins is awesome!

- “Focus on what you have rather than what’s missing, as this habitual pattern leads to happiness, while the opposite can result in frustration, worry, and depression.”

- “Private equity has outperformed public markets by an average of 50% per year over the past 37 years, with the ultra-wealthy allocating 46% of their portfolios to private markets”

Scamming Seniors Is a Growing Problem. Wall Street Wants Washington to Stop It. – Barrons

- Elder Fraud is in the headlines almost every day these days. Here at AE we hear about our advisors clients being effected on a weekly basis.

- Doing an elder fraud lunch and learn would be a great idea to keep your clients in the know on what to look out for!

Morgan Housel – Do it your way

- I thought this article brought up some great points we can be talking with retirees about as we help them with their planning.

- “How you invest might cause me to lose sleep, and how I invest might prevent you from looking at yourself in the mirror tomorrow. Isn’t that OK? Isn’t it far better to just accept that we’re different rather than arguing over which one of us is right or wrong?”

Planning For Early Retirement

- Great article with a case study on early retirement.

- “Young people have time, income and human capital at their disposal to wait out bear markets and lean into them by buying at lower prices. Retirees don’t have that same luxury.”

- These are just some of the risks you have to contend with in retirement:

- Longevity risk (running out of money)

- Inflation risk (seeing a lower standard of living)

- Market risk (bear markets)

- Interest rate risk (fluctuations in yield or outright bond losses like we saw in 2022)

- Sequence of return risk (you get poor returns at the outset of retirement)