The long wait is over and the question of when and “how much is the Fed going to cut rates” has been answered.

The question you as the FA need to be asking is, how does this affect my clients and how do I make sure I get in front of their needs – Especially prospects.

- Have they been sitting on your advice without taking action?

- Do they need to be jumping on that product now before the rates affect the product?

- Do they need to refinance into the better rate now? (annuities and life that is)

Here are your Quick Hits:

Chart of the week:

Apple is spending $30 billion a year on R&D to find its next big thing

- We talk about having 10% of your marketing budget set aside to try and test new things every year. Seems like Apple is taking it to another level with 30 Billion dollars!

- Here is why: “If the prospect of a slightly better iPhone, with a slightly better camera, that is slightly more expensive than you want it to be doesn’t have you jumping up with excitement, rest assured you’re not alone.”

Schwab Survey Reveals That Americans Think It Takes $2.5 Million to Be Considered Wealthy in 2024

- This year’s study reveals that Americans now think it takes an average of $2.5 million to be considered wealthy – which is up slightly from 2023 and 2022 ($2.2 million).

- Americans say that the average net worth required to be financially comfortable is $778,000. The average net worth required for financial comfort reached a peak last year at $1 million,

- “Our survey reinforces that people with a written financial plan are more confident about achieving their personal financial goals. Financial planning helps people understand where they are today and create a roadmap to get where they want to be, whether someone is saving for a single goal, like retirement, or needs comprehensive planning and wealth management.”

Your Client Is Forced to Retire Early. What Should They Do?

- Great article to talk about on your shows or send to a prospect this week!

- It also gives a good check list and reminder for yourself as the planner too!

- “Early retirement, especially for medical or caregiving reasons, can result in unexpected expenses or changes in income, This is the time to go back through the budget and adjust where needed, possibly reducing noncritical spending to ensure their core needs are met.”

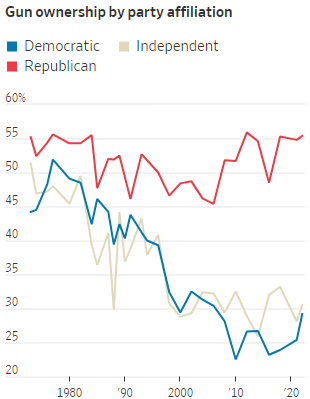

The Most Surprising New Gun Owners Are U.S. Liberals

- I know this has nothing to do with the financial industry or marketing, but it was too interesting not to share!

- “American gun culture has long been dominated by conservative, white men. Now, in a marked change, a burgeoning number of liberals are buying firearms, according to surveys and fast-growing gun groups drawing minorities and progressives.”