I hope everyone had an excellent Easter last week!

There is a lot of positive moves in the FIA space these days…rates are increasing every day. Make sure to call our team for an update on product to make sure you are selling the best that’s out there for your clients!

On the flip side of the coin I thought this quote was timely…

“The names change in every cycle, but the underlying story remains the same: you can’t buy past returns.”

There is a lot more to consider than just illustrations. Our team is here to help bring in all the details for you!

Make it an EXCELLENT week!

Here are your Quick Hits:

Prediction Consensus: What the Experts See Coming in 2022

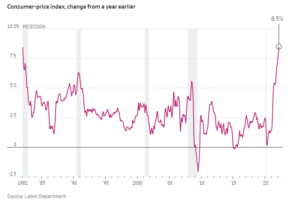

U.S. Inflation Accelerated to 8.5% in March, Hitting Four-Decade High

6 things to consider before you move in retirement

- Fun article to share with prospects and clients

- “Of those who purchased new homes, 18% were younger baby boomers, ages 56 to 65, and 14% were older boomers, ages 66 to 74”

- Retirees face certain challenges when applying for a mortgage. “The biggest hurdle is verifying their incomes to show lenders where their income is coming from,”

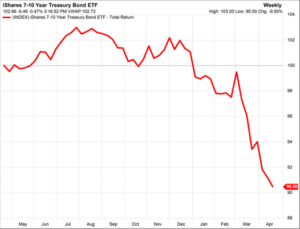

Opinion: Bond rout exposes Social Security’s insanity

- Every dollar of yours that’s invested in the Social Security trust fund is invested in low-yielding government bonds

-

- “The hole in Social Security jumped another $3 trillion last year and it will widen again this year, no doubt. The Social Security trust fund is expected to start running out of money in about a decade, at which point the people in Washington will either start hiking our taxes, cutting our benefits, or (one suspects) both. When that happens, expect the usual excuses, finger pointing, obfuscation, and lies.”

Could Index Funds Be ‘Worse Than Marxism’?

- Super interesting article where some economists are worried that the Vanguard model of passive investment portfolios are hurting the markets

- “Some $11 trillion is now invested in index funds, up from $2 trillion a decade ago. And as of 2019, more money is invested in passive funds than in active funds in the United States.”

- “For the most valuable public company in the world, three individuals can in principle swing the vote of 17 percent of its shares. Generally, a significant fraction of shareholders do not vote, even if in contested battles. As a result, the 17 percent actually represents more like 25 percent or more of the likely votes in contested votes. That share of the vote will generally be pivotal.” In fact, the Big Three cast roughly 25 percent of the votes in S&P 500 companies.

- “In recent decades, the whole economy has gone on autopilot. Index-fund investment is hyperconcentrated. So is online retail. So are pharmaceuticals. So is broadband. Name an industry, and it is likely dominated by a handful of giant players.”