Progress Requires Presence.

Between market swings, new retiree rules, and scaling pressures, it’s easy to default to tactics. But the best advisors, leaders, and marketers stay present—with clients, teams, and strategy. Whether it’s showing up with clarity in volatile times, simplifying your messaging, or following up on small wins—progress comes from staying engaged.

Here are this week’s insights to help you lead, grow, and deliver.

Here are your Quick Hits: Insights for Growth-Oriented Advisors

Worried About Tariffs and a Recession? Here’s What Retirees Need to Know

- Most retirees don’t need to make immediate changes to their withdrawal strategy during market volatility, but checking in with a financial advisor can help.

- Guaranteed income products like annuities are gaining popularity as a way to reduce risk and smooth out income

Podcast: “How to Be a Leader People Love to Follow” – The John Maxwell Leadership Podcast

In this episode, leadership expert John C. Maxwell delves into the qualities that make leaders truly admirable and effective.

Key Takeaways:

- Respect Is Earned Through Challenges: Maxwell emphasizes that genuine respect is often garnered during difficult times, not when things are easy.

- The Importance of Empathy: Leaders should cultivate a genuine care for their team members, understanding that people remember how leaders make them feel more than what they say or do.

- Creating a Positive Culture: By fostering an environment where individuals feel valued and inspired, leaders can build teams that are both loyal and high-performing.

- This episode serves as a reminder that effective leadership is less about authority and more about connection, empathy, and consistent positive influence.

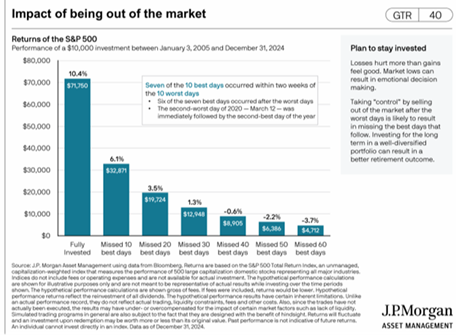

5 Helpful Charts for 2025

Morningstar’s 2025 Investment Outlook for Financial Advisors

- What will look different about the investing landscape in 2025? With inflation diminishing and interest rates starting to come down, attractive opportunities, as well as risky ones, will present themselves to investors.

- Regardless of what changes, what remains timeless is the importance of creating portfolios that meet your clients’ long-term investment goals as opposed to chasing headlines and returns.