It seemed as “The Markets” were a part of every conversation I had this week (Shocker Cory, you work for a financial services company), but even with family!

So I thought I’d do a market version of the quick hits this week.

Side note – Last QH before the 4th quarter! Let’s Go!

Here are your Quick Hits (Market Style)

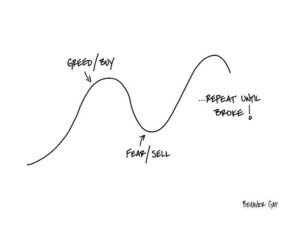

How fear and greed kill returns

- “Most of us make the same mistake with our money over and over: We buy high out of greed and sell low out of fear, despite knowing on an intellectual level that it is a very bad idea.”

- “It’s OK to feel it. But understand that acting on it will cause financial harm.”

- Invoking the imagery from the Robert Frost poem “Fire & Ice,” the Morgan Stanley strategist said that he sees earnings revisions from American corporations “and higher frequency macro data” pointing to a decelerating economy, “amid demand pull forward, supply chain issues and margin pressure,” which he forecasts could lead to a 20% drop, a near-term outcome that he describes as “ice” for investors,”

- “Wilson wrote that he is starting to see a 20% fall as a “more likely” outcome for equity markets.”

- “If you’re a consumer, a high-net-worth household, or even a massive-affluent household, and you’ve had your money in the stock market, you’re feeling pretty flush right now,”

- “If you’re a wealth manager, you probably think you’re doing really, really well. The reality is everyone’s doing really, really well.”

- LOVE THIS QUOTE/STAT: “Women are more worried about running out of money,” said Cheryl Nash, CEO of InvestCloud Financial Supermarket, in a comment Roame cited. “They outlive men so they need more savings.”

- Median household income was $67,500 in 2020, down 2.9% from the prior year.

- The poverty rate in 2020 was 11.4%, an increase of 1 percentage point from 2019 and the first increase after five consecutive years of declines. That translated to 37.2 million people in poverty, an increase of 3.3 million from 2019.

- Without the first two rounds of stimulus checks issued last year, the broader poverty measure would have risen by almost a percentage point instead of dropping, the bureau said. Specifically, stimulus checks moved 11.7 million people above the poverty threshold if their effect was calculated alone.

- The unprecedented rise in net worth reflects two defining trends of the US economy in 2021: a surging stock market and a white-hot housing market. Of the $5.85 trillion increase in net worth, stocks accounted for $3.5 trillion, and real estate appreciation was responsible for $1.2 trillion.

- Higher net worth also came with a big surge in IOUs. Household debt jumped 7.9% in Q2, a more rapid pace than in previous quarters, spurred by skyrocketing home prices and cheap borrowing costs.