Ever notice how the news is always 3 steps behind what we are already thinking and or feeling?

Example: People have been talking about inflation hitting home all last year, and now all the sudden expensive eggs are big news?

Surveys and consumer reports are lagging indicators on how people are “Feeling.” That means, the source of the issue has already happened and it’s causing this feeling.

The news follows these feelings, then writes about them.

Takeaway: Your clients (more importantly prospects) are steps ahead of the news…the news just solidifies what they’ve been feeling.

What can you do about it?

Take polls, ask questions to your clients on how they are feeling about their status, how they are feeling about the future…they are the leading indicator on what is about to come.

If your prospects and clients are feeling the effects of rising rates, expensive groceries, no ability to buy the house they wanted, and rising taxes …Feel free to market to that feeling.

Don’t wait for the news to catch up.

Here Are Your Quick Hits:

Are Advisors Communicating Enough with Their Clients?

- I love a good survey and this one is right down our alley!!

- “we examine how advisor-client relationships have changed since Covid-19. In particular, we asked 670+ clients if their advisors are communicating with them enough.”

- “About half (47.1%) of surveyed clients wish their advisor would contact them more. Drilling a layer deeper, an even greater percentage of both the higher net-worth (53.4%) and under 60 demographics (55.8%) wish their advisors contacted them more frequently.”

‘Timing couldn’t be worse’: Inflation might be slowing, but people say it’s getting harder to cover unexpected costs — and the next Fed meeting won’t help

• “A record number of people say they would need to pay for an unplanned $1,000 expense by using their credit card, according to a new survey showing the burden of high prices even as inflation rates ebb from four-decade highs.”

• But others aren’t convinced. “Most of America today has absolutely no money, if you look at it,” personal finance expert Suze Orman said this week on CNBC.

Existing home sales fell for the 11th consecutive month in December, hitting the slowest pace since November 2010

• It is the slowest pace since November 2010, when the nation was struggling through a housing crisis.

• Home sales have now fallen for 11 straight months, due to much higher mortgage rates.

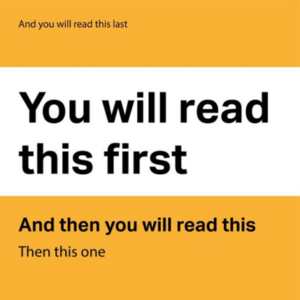

A quick lesson in Marketing: