Everyone wants to be able to see the future, right?

It’s a big reason I started these quick hits, was to give you up to date, relevant to our industry, trends that may show you what to expect with your prospects and clients and nuggets you can market with.

When does wanting to know the future so you can do something about it now, become illegal?

This week, there was a lot of articles about when you control the future of companies, should you be legally allowed to invest in them?

Here is a Wall Street Journal article talking about how thousands of senior executive employees owning shares in companies whose fates were affected by their own actions…Uh-oh

This quote might be a little troublesome to the everyday investor…

- More than five dozen officials at five agencies, including the Federal Trade Commission and the Justice Department, reported trading stock in companies shortly before their departments announced enforcement actions, such as charges and settlements, against those companies.

What can we do about it as wealth planners and investors…?

If you can’t beat them, do we join them?

Here is a list of companies Nancy Pelosi’s husband has been trading recently to the tune of $46,000,000.

Here are your Quick Hits:

Quote of the week:

“Believe it or not, most retirements fail for non-financial reasons, rather than for financial ones.” – Mike Drak

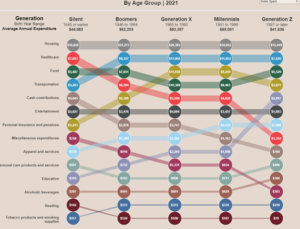

How Do Americans Spend Their Money, By Generation?

- This is a great interactive chart to see what difference generations are spending their wealth on.

What we keep getting wrong about inflation

- Solid article to talk through what inflation REALLY is and what it is not

- “In Inflation World, inflation is a monetary phenomenon and needs a monetary response such as higher interest rates. In Energy Crunch World, the rise in prices needs a real-world response in the form of support for struggling households, and every effort to reduce demand and to find new sources of supply.”

The 5 Best Financial Innovations—Ever

- Fun article to share or talk about on your shows.

- Can you or your clients guess all 5?

- No Bitcoin doesn’t make the list!

Household Debt Surges as More Americans Live Paycheck-to-Paycheck

- As of June, 61 percent of Americans—or about 157 million adults—are living paycheck to paycheck. That figure is up from 58 percent that was registered in May and 55 percent compared to a year ago.

- “The impacts of inflation are apparent in high volumes of borrowing,”

In the end, there are a lot of ways we can try to see the trends or future, but the best way is to have a plan. If part of that plan is to not lose money, we’ve got plenty of GREAT solutions where we can make that happen.

Make it a great week!