2022 is off!

A mentor of mine asked these questions to an advisor and they were too good not to share as you launch into 2022:

- When you think about Vivid Vision instead of just wanting to get too $100 million are you clear what you want the business to look like?

- What’s top challenge today you are trying to overcome?

- What is your current #1 stressor?

- Are you thinking office or market expansion?

- Do you want to be selling customers?

- What’s his longer plan for leadership of the business?

Book Share:

Here are a few of my favorite books from this past year:

- The Five Dysfunctions of a Team: A Leadership Fable

- Been recommended so many times, I finally got around to reading it. Worth every minute for anyone who has a team around them.

- “If you could get all the people in an organization rowing in the same direction, you could dominate any industry, in any market, against any competition, at any time.”

- The Advisor Playbook

- One of the best Financial Advisor Books I’ve read!

- “A consultant asks a client to buy into something long-term and those relationships are connected by an aligned philosophy, planning strategy and process. As I’ll repeat on many occasions in this book, your solutions should be bought, not sold.”

- Scaling Up: How a Few Companies Make It…and Why the Rest Don’t

- The perfect book for any entrepreneur, business owner or Team Leader.

- “Goals without routines are wishes; routines without goals are aimless. The most successful business leaders have a clear vision and the disciplines (routines) to make it a reality.”

- Right Away & All at Once: Five Steps to Transform Your Business and Enrich Your Life

- Read this if you want to get your business to where you want to go quickly!

- “Have a plan and track your progress Identify the three to five actions that, if executed, will fundamentally improve your business. Write them in a one-page plan, communicate them to your organization in an understandable way, and relentlessly measure your progress.”

Here are your Quick Hits:

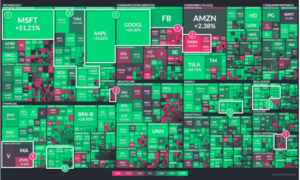

US Stock Market in 2021: Best and Worst Performing Sectors

Early Retirement Tax Planning Checklist

- Great article sharing what a pre-retiree should be thinking through before retirement.

- Tax planning in early retirement involves:

- Establishing a framework

- Automating all tasks that can be reasonably automated

- Developing systems and following a checklist to assure we complete tasks that can’t be automated.

What Courageous Leaders Do Differently

- Courageous leaders display openness and humility

- Pretending to be fearless no matter how good the reasons to be afraid, or acting like a know-it-all no matter how obvious it is that neither you nor anyone else has all the answers, isn’t impressive. It’s dangerous — for yourself and for those who depend on you.

- Courageous leaders put principles first

- Real leadership isn’t about winning a popularity contest. It’s about doing important work on behalf of others. And because there are always going to be differences of opinion and limited resources, you’re probably not going to make much progress on that important work if you can’t stand the thought of upsetting some people some of the time

- Courageous leaders focus on making environments safer for others

- In the vast majority of organizations, entreating people to routinely stick their necks out despite legitimate fear isn’t exactly a sign of strong leadership. Yet that’s what leaders who “encourage courage” are essentially doing. They’re implicitly saying that because they aren’t courageous enough to change the conditions in their organization to make it safer for people to be honest, try new things, or take other prudent risks, everyone else should be courageous enough to do them anyway.

Three signs you’re ready to retire

- “Instead of earning a paycheck, for example, retirees have to create one from their savings and other resources. If something goes wrong – the furnace dies, or their investments don’t do well – they can’t just earn more money to make up for any shortfall.”

- You may need some time to prepare yourself mentally and emotionally for retirement. Just don’t let the preparation continue indefinitely, since the future is never guaranteed, Gearig points out.

- “Just jump in and enjoy the ride,” Gearig says.