I’m interrupting this weeks’ market and business focused “Quick Hits” to hit you with something that I needed a reminder of. You all are THE BEST in this industry, yet you are still striving to be better every day.

I love it!

I’m encouraged and inspired by you.

That being said, I was reminded to stop and be grateful this week with all the things going on in this world.

I encourage you to check out the “Happy When” article below…It was timely for me.

A quote I love on this topic is from Hal Elrod:

“Love the life you have while you create the life of your dreams.”

Have an amazing Memorial day weekend and lets remember to be thankful for those that paid the ultimate sacrifice for us to live the lives we have.

Here are your Quick Hits:

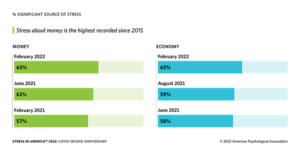

Stress in America Survey

- Americans are more stressed about money than they’ve ever been, according to the American Psychological Association’s latest Stress In America Survey.

- “Eighty-seven percent of Americans said that inflation and the rising costs of everyday goods is what’s driving their stress,” said Vaile Wright, senior director of health care innovation at the American Psychological Association.

I’ll be Happy When

- Great article and story around being content and happy now. Always a great reminder!

- “What is an achievement you been telling yourself will make you happy, but may not in reality?”

- “We should focus less on finding the right destination for ourselves—living in a certain city, finding the perfect home or getting our “dream job,” which is often just a professional fantasy—and instead focus on finding more ways to enjoy and bring purpose to our current place each day.”

My Investing Philosophy in a Nutshell – Barry Ritholtz

- I thought this article was great and made some solid points for the common investor from a well known CIO of Ritholtz Wealth Management.

- Best quote was: “I define investing as follows: “Investing is the art of using imperfect information to make probabilistic assessments about an inherently unknowable future.””

Surveys show Americans prefer retirement planners, lack plans

- “According to the survey released Wednesday by the Granum Center for Financial Security, retirement income planning was the service that was most desired by both older and younger consumers (71%), and was equally popular among men and women. Meanwhile, 3 out of 10 consumers (31.3%) chose “understanding how much I can safely spend in retirement” as the top service they want from a financial adviser.”

- “Last year, the percentage of working Americans nearing retirement age (60-67 years old) who said they have enough money to retire was 26%. As a result of spiking inflation, that number has declined to just 22% this year, according to the study.”

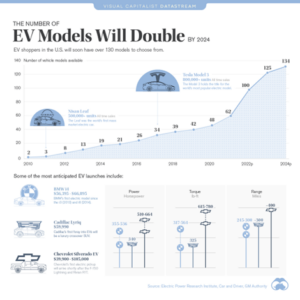

Looking into investing into Electric Vehicles? The Number of EV Models Will Double by 2024