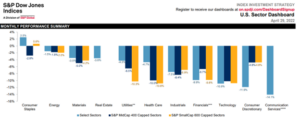

Anyone else FEEL like things are worse than the S&P only being down 16%?

Make sure to check out the “It feels worse” article that will help explain how these indices work and what stocks are keeping things afloat.

Regardless of what the numbers are doing, your clients and prospects absolutely feel worse than what the numbers show. Keep loving on the clients and keep marketing to the ones that need your help!

With every crisis comes opportunity:

- Our vendor marketing partners are all running promotions right now to help you market.

- The annuity carrier rates are higher than I’ve seen in over 10 years

- Response rates to events are double what they were a year ago

Keep up the momentum!

Here are your Quick Hits:

Great podcast from John Maxwell – Essentials of Opportunity

- Motivated people often find opportunities

- Opportunities often find motivated people

Building Vs. Betting

Full list of Market Performance here (Hint: it’s not looking good)

- Another great site to use with your research is “Don’t quit your day job” – DQYDJ.com

It Feels Worse – Great article on how it feels worse than the number show

- “The average stock in the S&P 500 is in a 21.8% drawdown, so it’s understandable why the first number feels off. The thing is, the index is market cap-weighted, so the average decline and the index decline rarely line up.”

- One hundred three stocks representing 20% of the S&P 500’s market cap are within 10% of their 52-week high. These are some of the largest names holding up the index. Each is within 10% of its 52-week high:

- UnitedHealth

- Johnson & Johnson

- Walmart

- Proctor & Gamble

- Exxon Mobil

- Mastercard

- Coca-Cola

- Eli Lilly

- Pepsi

- Merck

- “…we’ve only looked inside the stock market, specifically the S&P 500. Once you factor in the Ark complex blowing up, the bond market getting crushed, inflation not slowing down, home prices rocketing, and the fed removing liquidity from the markets, it’s easy to understand why things feel a whole lot worse than they actually are.”

8 Inflation Conversations For Financial Advisors To Have With Clients – Kitces