Happy belated 4th of July! I hope everyone enjoyed the time to celebrate the many, many blessings we have in this country because of our freedom.

I believe the incredible lives we live here in the U.S. are 1 thousand times better than anywhere else in the world.

- 1/3rd of the world lives on $2 a day.

- The global average salary is $1,480 a month

That’s just the money side of it, we could spend all day talking about health care, safety, schools, transportation and on and on.

We won the birth country lottery if you think about it.

Let’s get out there and help these U.S. Retirees!

Here are your Quick Hits:

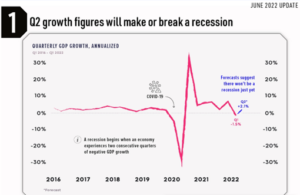

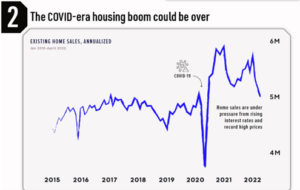

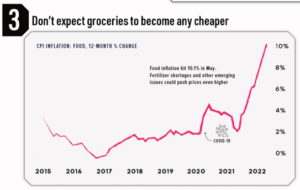

3 Insights From the FED’s Latest Economic Snapshot

33 Problems With Media

- Acknowledging these shortcomings is the first step to solving them.

- “Slactivism: Symbolic gestures like profile picture flair can feel like activism, but ultimately don’t affect change in the real world.” – Ouch!

Cooling Consumer Spending Points to Further Economic Slowdown

- “Consumer spending cooled to a 0.2% advance in May, the Commerce Department said Thursday. That was the smallest monthly gain this year, and down from the revised 0.6% increase in April.”

- “This solidifies evidence of a downward trend in consumer spending, which is the backbone of the economy,” said Lindsey Piegza, chief economist at Stifel Financial.

6 Things To Know About Stock Market Crashes and Downturns

- From time to time, stock markets go through long and deep periods of decline.

- After a large decline, it is hard to predict how long it will take for stock markets to recover.

- Over the very long run, stock markets have been very generous to investors who can get through long periods of decline.

- During times of a rapid and deep decline, investors should avoid panic selling.

- The standard bell curve is an inadequate model of stock market returns. A model that can capture the extreme risks of the equity market (its “fat tails”) is needed.

- Sometimes, the market and economy move in opposite directions.