Consumer Sentiment is at one of the lowest points it’s ever been since they started tracking it in the 70s.

Here is an advisors perspective article to explain a little more.

What does that mean to you and your marketing?

In my opinion, what I’m seeing is people are in the “Freeze” mode. They don’t want an advisor to come along and offer a plan for the future. That is secondary to their needs now. They want to know what to do TODAY!

They are asking: What are you Mr. or Mrs. Advisor going to do this month to help me get back to where I was and back into a plan?

Action items to think about: start talking about suggestions in your marketing on action items prospects can be taking right now in this environment. Give them FREE Value to act on right now. They want answers…then they want a plan.

If your answers help now, they’ll trust you for the plan.

Here are your Quick Hits:

Young adults are taking longer to reach ‘key life milestones’ impacting finances later, analysis shows

- Interesting article that shows more kids are in college than in 1980 so they are delaying full time jobs, thus delaying “key life milestones.” Not sure if this is a good or bad thing? Only time will tell.

- “In 2021, adults who were 21 were less likely to have a full-time job; be financially independent, living on their own or married; or have children than their predecessors from 1980.”

- “Still, older generations are more likely to think their children should be completely financially independent by age 21, according to an April report from Bankrate.”

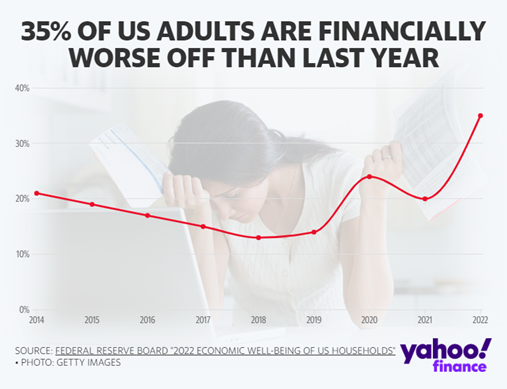

More Americans are feeling lousy about their finances, Fed study finds

- Solid article to use in your drips this week!

- “The share of Americans who feel worse about their finances hit the highest level since 2014,”

- “Many took steps to mitigate the rise in prices. For instance, two-thirds stopped using a product or used less of it, while 64% switched to a cheaper option. Almost half put off a major purchase, while just over half cut back on saving.”

There’s Rarely a Case for Pulling Out of the Market. This Might Be One.

- Great article from Barron’s to talk through on your radio and podcast this month

- “Looking at it pessimistically, the possibilities make you wonder if the best strategy at the moment is stuffing all your money under the mattress at home—the classic move of the extremely risk-averse investor. Sell in May and go away, the old stock market adage goes.”

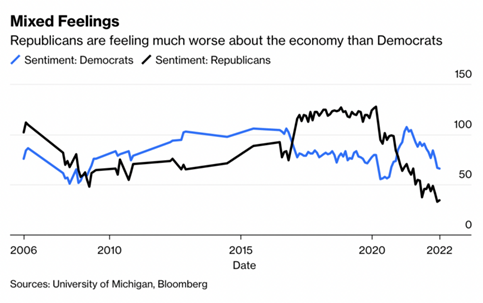

Is Partisanship Driving Consumer Sentiment?

- I thought this article took a different angle on consumer sentiment right now. They make some solid points.

- “It is astounding that sentiment today is even worse than the levels it sees in the midst of the very worst modern financial crises and epic generational market crashes. Winkler’s point is this level of negativity makes little sense economically but is more consistent with partisanship (see chart at top).”