With turmoil in our homeland, volatility in the markets, uncertainty in future leadership, you would think people would be wanting to make changes to protect themselves or have a plan for any scenario!

I’ve heard two sides of this coin. People are either ready to make a change and take action and some are freezing in uncertainty.

It’s time to turn up the heat on the “Closing Window” we have, to make changes.

If you aren’t the “Pushy Salesman” usually, it’s time to get out of the comfort zone and nudge these prospects and clients to make changes. As salespeople, this is our job and duty for their livelihood. If they don’t do what you tell them, things might not go well for them.

It’s more important now than ever to listen to the sound advice of a Financial Advisor (That’s YOU)!

(Cory Steps off soapbox)

Here are a few Quick Hits to help you, help them Take Action:

No Stimulus Means Economy’s Fate Hangs On Next Few Months

· With the breakdown of U.S. fiscal relief talks on Tuesday, the timeline for a robust economic recovery might now be an early 2021 story.

· The good news is that as we enter October, the private sector continues to show steady momentum.

New Income FIA – Refunds Fee back to client

· Top 3 guaranteed income product on the market

· Fee has ability to be refunded every year

· Top account value growth compared to all Income Riders on market · Click here to grab 15 minutes to run through the details.

· Understand what prospects really want to hear

· Know exactly what to say with simple scripts

· Gain confidence in your calling abilities

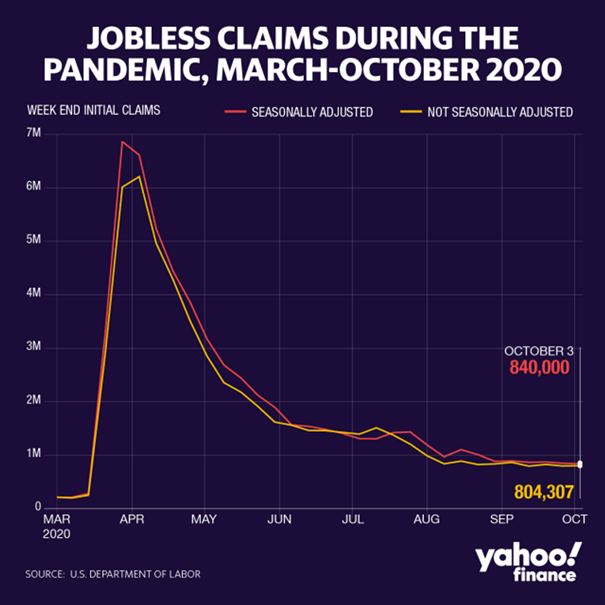

Jobless Claims are still Really High

The 10 Most Useless Phrases in Finance

· One of my favorites – “Earnings missed estimates.” This phrase is backwards. When an analyst creates an estimate as to a company’s next quarterly profit, he or she is making an educated guess as to that future data.

· “Useless finance phrases have a pernicious effect on our psyche, leading us to blindly accept ideas that should instead receive critical analysis.”

“Historical returns often paint a distorted picture; rigid rules have unintended consequences and the market loves to make monkeys out of people who think they’ve solved it.”

– Jason Zweig