There has been a lot going on in the market this week so I thought I’d share a few articles you can bring into to your conversations.

Specifically I focused on the traditional 60/40 portfolio, which I know most of you structure the “40%” much differently than what these articles are speaking to, but most of your prospects have the traditional style.

Sounds like a lot more people need your help!

Have a great week.

Here are your Quick Hits:

60/40 Portfolio Set for Worst Loss Since March 2020

- “The Bloomberg 60/40 index has lost 5.4% in January, its worst showing since a slump of 7.7% tied to the start of pandemic lockdowns and a brief recession.”

- “Investors owning a long term mix of equities and bonds only need to look back to 2018 for how Fed tightening can spark negative returns.”

- I’ve got an idea of what you can do with the “40” part of the portfolio. 😊

Marketwatch Opinion: Inflation will hurt both stocks and bonds, so you need to rethink how you’ll hedge risks

- The article gives some great points on how the 60/40 split is putting the investor at risk, but doesn’t give the best options on how to fix it…

- “The traditional 60/40 portfolio will bring massive losses, so it’s time to invest in something other than bonds to provide some safety and income.”

- “When inflation rises, returns on bonds become negative, because rising yields, led by higher inflation expectations, will reduce their market price. Consider that any 100-basis-point increase in long-term bond yields leads to a 10% fall in the market price—a sharp loss.”

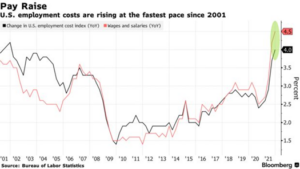

Wave of U.S. Inflation Data Reinforces Fed Pivot to Higher Rates

- Employment costs post largest annual gain in two decades

- Closely watched price index rose last month by most since 1982

Some Things I Remind Myself During Market Corrections

- “There’s an old saying that people don’t go to church on Sundays to hear the 11th commandment. They go to reinforce the 10 commandments that are already in place.The same is true of investment commandments.”

- “Buy and hold requires you to do both when stocks are falling. It’s much easier to both buy and hold when stuff is going up.”

- “You don’t know when and you don’t know why but you know it’s going to happen. Plan accordingly.”

How to create leadership objectives for a growing team

- The majority of my conversations these days are around growth, structure and leading teams. I thought this article gave some great tips on how to set your team up for success.

- “Milestone-based goals also let you offer your employees today’s most sought-after job feature: autonomy.”