Merry Christmas and a Happy New Year!

I’m sad to say this will be the final Quick Hits of 2024.

Quick Hits began when I realized how often we get asked for recent articles or valuable content you could use for your shows or in your weekly client touches. Over the years, it’s been incredible to see the impact. This marks our 238th edition!

One of our offices shared something encouraging that I hope resonates with you as well:

“Maybe not all the ideas, strategies, or content you send us are relevant right now, but there’s always something I can grab. What I’ve realized is that I’ve probably seen that idea before, but it’s the TIMING OF THE VALUE that matters.”

We’re committed to continuing to deliver value because we never know when the timing will be just right for you to seize it and run.

Thank you for making 2024 such an amazing year. I’m excited to see what you accomplish in the year ahead!

May God bless you, your families, your teams, and your clients in 2025.

-Cory

Here are your Last Quick Hits of 2024:

Why empathy should be your top leadership priority

- Employees crave genuine understanding from their leaders—here’s how to deliver it effectively in 2025.

- “A recent survey of 1,000 U.S. workers found that 52% felt their company’s efforts to be empathetic weren’t genuine. That’s a big disconnect between what leaders think they’re doing and how employees actually feel.”

- “As CEO of Jotform, I’ve learned that an open-door policy is a good start to demonstrating empathy, but it’s not always enough. Taking the time to personally check in with employees, actively listening, and working together on a strategy to navigate any challenges have proven far more effective. And I think that’s part of the reason why employees tend to stay with our company—because they know that management and leadership are genuinely invested in their wellbeing, engagement, and long-term success.”

The Next Bear Market Will Spark A Retirement Crisis,

- Great article with some big opinions from the Former Chief Economist at Merrill Lynch.

- “What’s most alarming is that equities now account for more than 70% of the U.S. household balance sheet, he said. “For the retiring baby boomer community over 60% of their asset mix is in equities, which is double where it should be at this stage of their lifecycle,” he argued.

- He advises investors to diversify into other geographies such as Japan and India, both of which have “secular tailwinds.” And Rosenberg continues to pound the table for Treasury bonds and notes since the Fed easing cycle is around the corner.

Vanguard To Investors: Time To Get Out Of Cash

- “calling for investors to put their money to work is as the Federal Reserve cuts interest rates with inflation decreasing.”

- “In 16 of the last 17 cycles, the five-year portion of the curve outperformed cash while in six of the last seven cycles that outperformance has been significant, or between 10-30% better than cash, according to the report.”

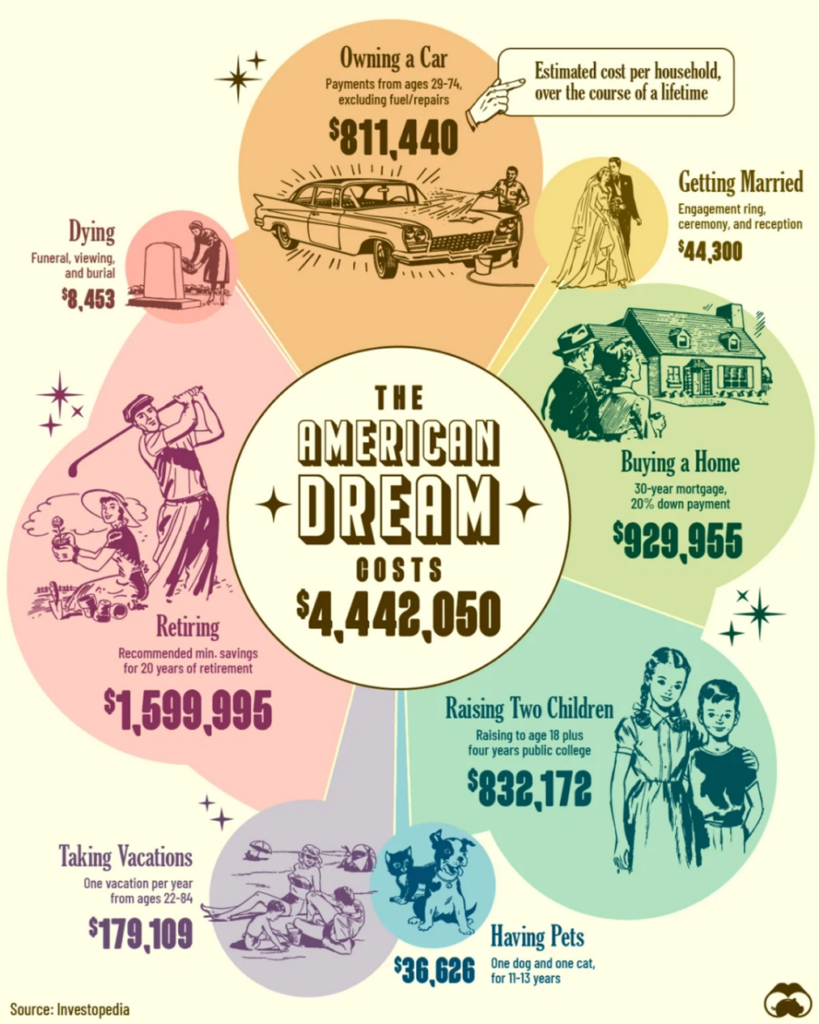

Top Visual of the year

5 Tech Trends that will shape the next 100 years – a thread

- He predicted the rise of:

- AI

- Remote work

- Digital streaming

- Years before they happened.

- Now, Kevin Kelly says these 5 tech trends will shape the next 100+ years: