Here are your Quick Hits:

NAFA’s Guide to the DOL Ruling

- NAFA has come out with a new summary guide of the DOL rule and I thought it was really well done.

- “Labeled the “Retirement Security Rule,” the DOL upends a five-part test that has been in place for nearly 50 years to determine fiduciary status and replaces it with a much broader test, the result of which will capture nearly all qualified retirement advice activity under a fiduciary standard.”

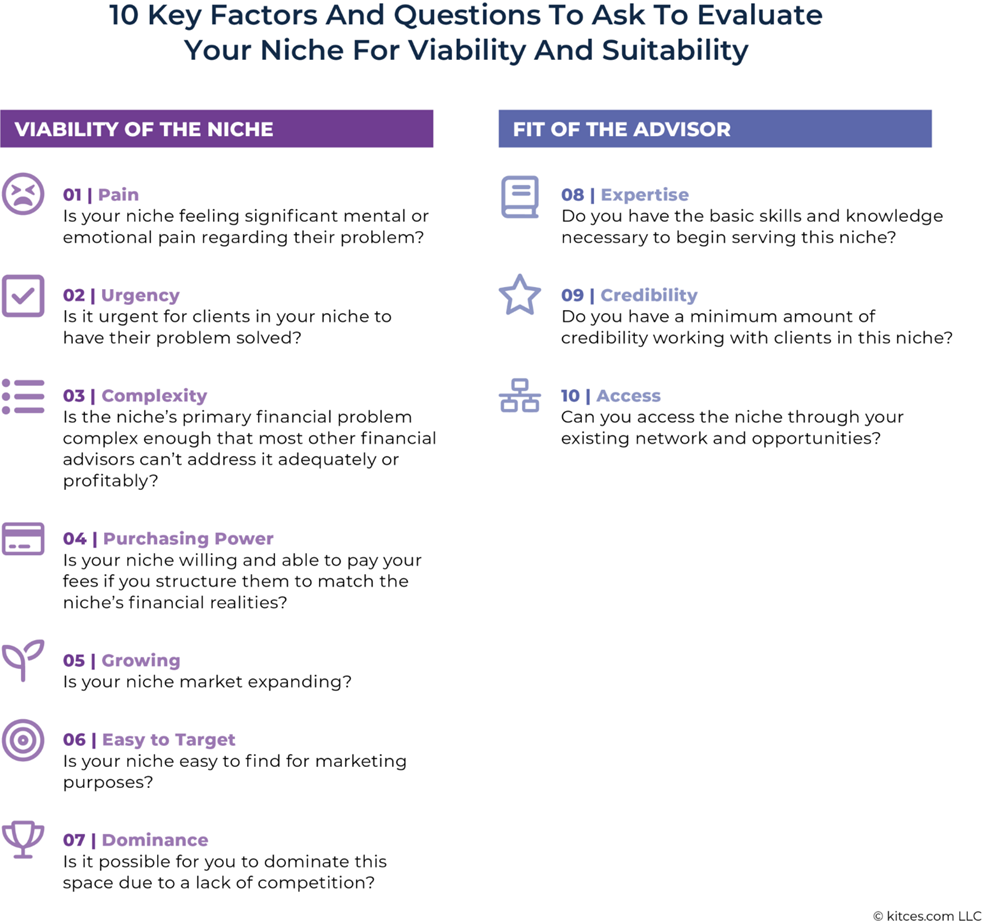

10 Factors To Determine If Your Potential Niche Is Really Viable (And How To Finetune If Necessary)

- Everyone “knows” they need a Niche to market to, but do we REALLLLY have one?

- This article brings up some great points.

- “Ultimately, the key point is that advisers who serve a well-defined and narrow niche whose members have a specific and difficult problem are in a much better position to build a thriving, successful business.”

Wall Street’s Favorite Recession Indicator Is in a Slump of Its Own

- “The yield curve has been inverted for a record stretch—around 400 trading sessions or more by some measures—with no signs of a major slowdown. U.S. employers added a solid 175,000 jobs last month, and economic growth this quarter is expected to pick up from earlier in the year.”

- “The curve inversion, especially earlier on in the cycle, played a major role in the psyche for investors,” he said. “But I do think now this has become kind of the new normal.”

Should you be a finfluencer?

- Love new terms like “Finfluencer” – This one you might want to know more about as a financial Advisor.

- “Social media is the new storefront. Advisors could miss reaching people looking for information, who instead get it from a bad finfluencer.”

- “More than half of Gen Zers and millennials rely on social media for investing information, along with nearly a third of Gen Xers, according to 2023 data from consumer research firm Hearts & Wallets.”