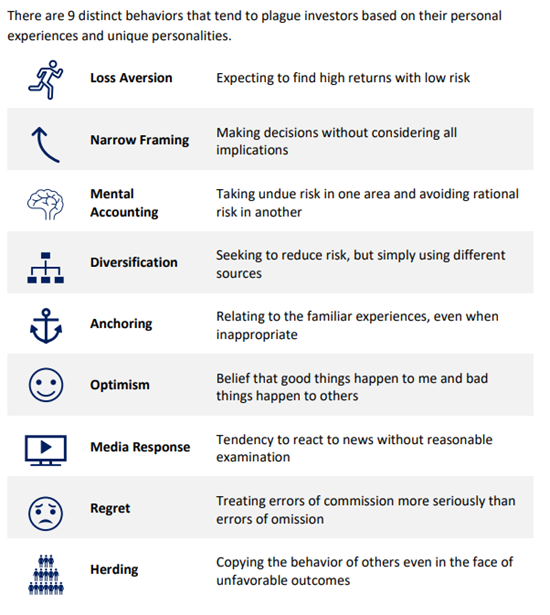

This week I’ve seen a few things come out on investment behavior and I had a couple thoughts around what I feel might be happening at the moment.

Lead flow numbers are down, Seminar attendees are down, Appointment and stick ratios seem to be coming down as well.

Business is UP…but primarily from current clients.

What might be happening?

My two cents:

With all the changes going… interest rates, market volatility, inflation, US backed wars, climbing debt and the list goes on, we as humans have a few natural reactions.

We either fight, fly or Freeze.

We gatta push them to fight.

Take them out of the flight mode.

Give your clients the tools to fight.

Have a plan for them.

Here are your Quick Hits:

70% of Americans are feeling financially stressed

- Interesting article to talk through on your radio and Podcasts!

- “Inflation, economic instability and a lack of savings have an increasing number of Americans feeling financially stressed.”

- “Nearly 60% of respondents cited inflation as the main contributor to their financial stress, followed by economy-wide instability (43%), rising interest rates (36%) and a lack of savings (35%), according to the survey of 4,336 adults, which was conducted at the end of March.”

Quantitative Analysis of Investor Behavior -DALBAR

- I always love when this comes out! So much great info to use in your marketing and language when talking with prospective clients.

- “The Average Equity Fund Investor finished the year with a loss of -21.17% versus an S&P

- ss of -18.11%; an investor return gap of 306 bps.”

- “A buy and hold strategy of $100,000, earning S&P returns, would have lost $18,111 and ended with a balance of $81,889.”

The Sneaky Way Productive Leaders Procrastinate

- Great article that was shared with our team from one of AE’s Owners Dave. I thought it was super impactful for me!

- “But leaders are people, too, and they do what everyone does on occasion. They procrastinate.”

- “Strangely, however, they procrastinate in an unusually productive way which gives the illusion that they are not procrastinating at all. They push important tasks off to the side and replace them with tasks that don’t matter nearly as much. Not surprisingly, they make great progress on these less urgent and less critical tasks, giving themselves and others the impression they are being highly productive.”

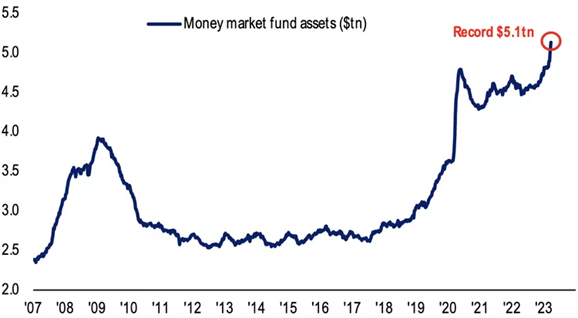

Money Market Funds Attract $300 Billion in Four Weeks, Fastest Pace Since 2020

- This chart and article are super interesting and a little worrisome. Last 2 times we’ve risen this fast we were either in a recession or about to be in one…