You care more about giving your dog her pill than keeping up with your own!

Watch the video for my explanation…

When was the last time you reviewed your retirement plan, your exit plan, your “just in case something happens to me” plan?

You all are THE BEST at caring for your clients, make sure you review your own plan too!

Here are your Quick Hits:

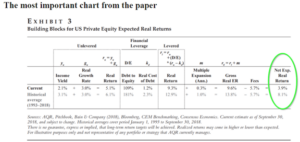

EXPECTED RETURNS FOR PRIVATE EQUITY WILL PROBABLY SUCK

- Great article for High net worth clients seeking non-market style returns! I know something a little less risky with higher net return to the client!

- “As investors increasingly avail themselves of the “benefits” of private equity (PE), the calculation of risk and returns to PE is under increased scrutiny. This asset class’s illiquid nature challenges the industry’s approach and methodology today. The mark-to-market quality of public markets is not present in the case of private markets.”

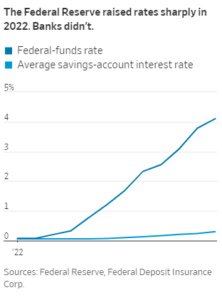

Rich Customers Pull Money From Banks Offering Paltry Interest Rates

- “Every time the Fed hikes, the opportunity cost of leaving idle cash in low-yielding accounts increases,” said Jason Goldberg, an analyst at Barclays PLC. “You’re seeing consumers who have extra cash being proactive with it.”

- The flight of wealth deposits poses a big business issue for firms such as Charles Schwab Corp., which relies on the extra cash that investors leave in their accounts for a large part of its revenue.

-

Market Performance During Recessions

- Great article outlining how markets perform during recessions.

-

- Most recessions last less than one year. In fact, only 3 of the 11 recessions since 1950 went on for more than one year.

- Most recessions have a period of significant stock market drops shortly after the recession begins.

- For every single recession, the stock market is recovering by the time the recession ends. About half the time (5 of 11) the market is back above breakeven by the end of the recession.

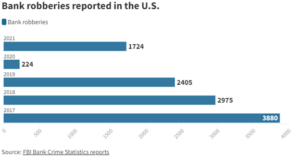

Denmark did not have a single bank robbery last year. This could explain why.

- Fun and interesting article on Denmark vs US in bank robberies.

- “Bank heists in the Scandinavian country have declined steadily since 2000, Michael Busk-Jepsen, director of digitalization at Finance Denmark, told USA TODAY Tuesday.

- Increased camera surveillance, improved alarm systems and stronger cooperation with the police have helped to bring the number down, he said. In addition, beefed-up security, a reduce used of cash and a dramatic decrease in the number of Danish cashiers also helped.”