Few stats to start this Friday off:

- Inflation hit another all-time high in May – 8.6%

- S&P as of 6/10 is down 18.53%

- Fed is going to continue raising Rates through September that will “Weaken the economy”

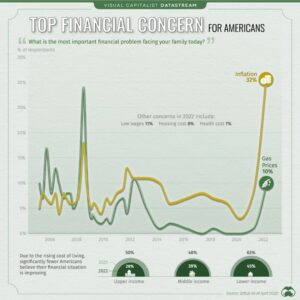

- Top financial concern for Americans right now: Inflation

- Gas and Natural gas isn’t the only power going up

If your clients have made good decisions to get out of the market, now the question is when do you get back in?

You can’t time the market – we all know that, but at the same time, we are supposed sell high and buy low.

What if you could participate in some of the upside without worrying if we are at the bottom of the dip?

Planning Suggestion: Find FIA products with high equity exposure like S&P indexes without any downside risk. Your team here at AE might know a few 😉

Here are your Quick Hits:

Poll: Inflation is the Top Financial Concern for Americans

Peter Mallouk: This Time Really Is Different

- “These were four very scary bear markets but they all had one thing in common: They all had a single cause,” Mallouk said, citing the tech bubble, 9/11, the 2008-09 financial crisis and the 2020 coronavirus pandemic.

- “In the past four bear markets, the Federal Reserve “was on the investor’s side” and pumping money into the system, Mallouk said. Now, given high inflation and low unemployment, “this is the first bear market in a long time when the Fed is on the opposite side” and wants the market to cool down, he added.”

- “That means owning the kind of assets that don’t require investors to worry about what happens to energy prices in the next six months or with the pandemic or the supply chain in the next year, Mallouk said.”

What If This Turns Out to Be a Terrible Time to Retire?

- Solid article to share or talk about on your radio and TV shows

- “retirees’ allocations to stocks should actually start out more conservative and rise over time. Once retirees are safely through the danger zone of losing a lot of money in the early retirement years, they can then increase equity exposure in the portfolio.”

Quote of the week:

“Risk is what’s left over after you think you’ve thought of everything.”

~ Carl Richards