Last week we ran through the details on what the Ukraine invasion means to your clients, I’d like to follow up with a few resources you can use and share with your clients and prospects from our Advisors Excel Team.

- Email from the Snappy Kraken team “Ukraine, What’s Next”

- Whitepaper from Fidelity – What does Ukraine Crisis Mean for Markets?

- Navigating Market Volatility Brochure

Here are your Quick Hits:

CNBC – If you’re nearing retirement, be sure you’re managing this big risk

- A main stream media outlet talking about “Sequence of Returns Risk!?” I didn’t think they even knew!

- “Anyone who’s nearing retirement may want to make sure their investment portfolio is constructed in a way that mitigates “sequence of returns” risk.”

- “The goal is to avoid being forced to sell investments for cash-flow needs if you retire in a down market.”

- “While it’s uncertain where stocks will go from here, volatility in prices is expected to continue.”

Fed’s Preferred Inflation Measure Reaches Fastest Pace Since 1983

- “The Commerce Department’s personal-consumption-expenditures index measure of core inflation, which excludes volatile food and energy costs, rose 5.2% in January from a year ago, up from 4.9% in December. That marks the sharpest 12-month increase since April 1983.”

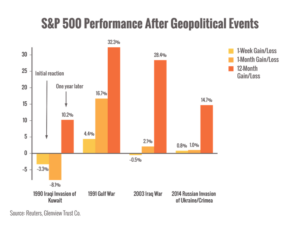

Investors Are Often The First Casualties Of War

- Interesting take from a historian on the war and it’s affects on investors.

- Key Point: “As an investor, you may not be interested in war, but war is interested in you.”

Reasons to Sell Stocks

Let’s Carpe the mess out of this Diem!